Summary

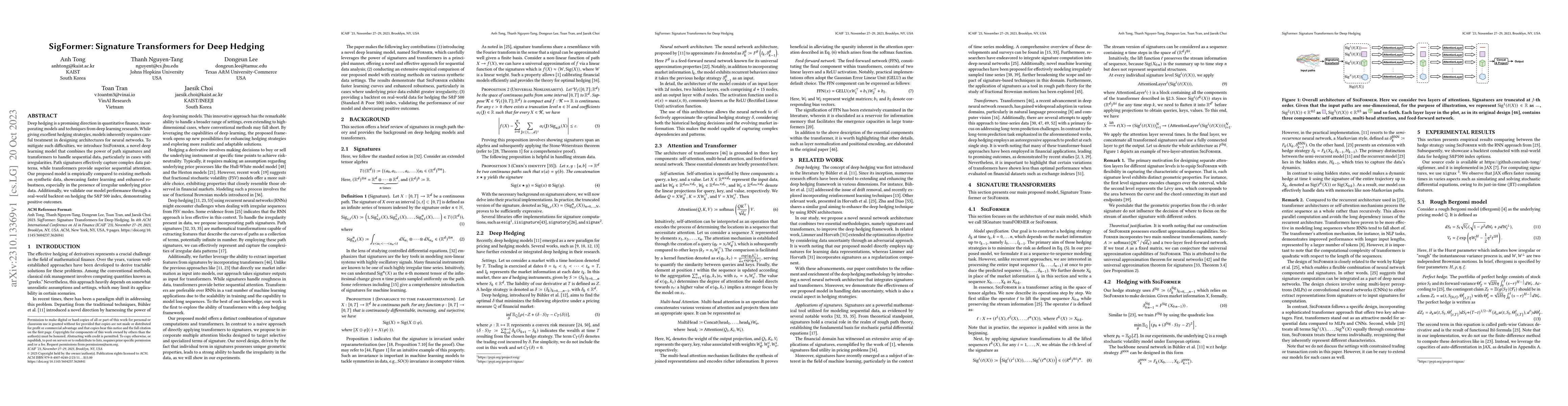

Deep hedging is a promising direction in quantitative finance, incorporating models and techniques from deep learning research. While giving excellent hedging strategies, models inherently requires careful treatment in designing architectures for neural networks. To mitigate such difficulties, we introduce SigFormer, a novel deep learning model that combines the power of path signatures and transformers to handle sequential data, particularly in cases with irregularities. Path signatures effectively capture complex data patterns, while transformers provide superior sequential attention. Our proposed model is empirically compared to existing methods on synthetic data, showcasing faster learning and enhanced robustness, especially in the presence of irregular underlying price data. Additionally, we validate our model performance through a real-world backtest on hedging the SP 500 index, demonstrating positive outcomes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSIGformer: Sign-aware Graph Transformer for Recommendation

Can Wang, Sheng Zhou, Jiawei Chen et al.

Deeper Hedging: A New Agent-based Model for Effective Deep Hedging

Wayne Luk, Kang Gao, Perukrishnen Vytelingum et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)