Summary

The extent to which a matching engine can cloud the modelling of underlying order submission and management processes in a financial market remains an unanswered concern with regards to market models. Here we consider a 10-variate Hawkes process with simple rules to simulate common order types which are submitted to a matching engine. Hawkes processes can be used to model the time and order of events, and how these events relate to each other. However, they provide a freedom with regards to implementation mechanics relating to the prices and volumes of injected orders. This allows us to consider a reference Hawkes model and two additional models which have rules that change the behaviour of limit orders. The resulting trade and quote data from the simulations are then calibrated and compared with the original order generating process to determine the extent with which implementation rules can distort model parameters. Evidence from validation and hypothesis tests suggest that the true model specification can be significantly distorted by market mechanics, and that practical considerations not directly due to model specification can be important with regards to model identification within an inherently asynchronous trading environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

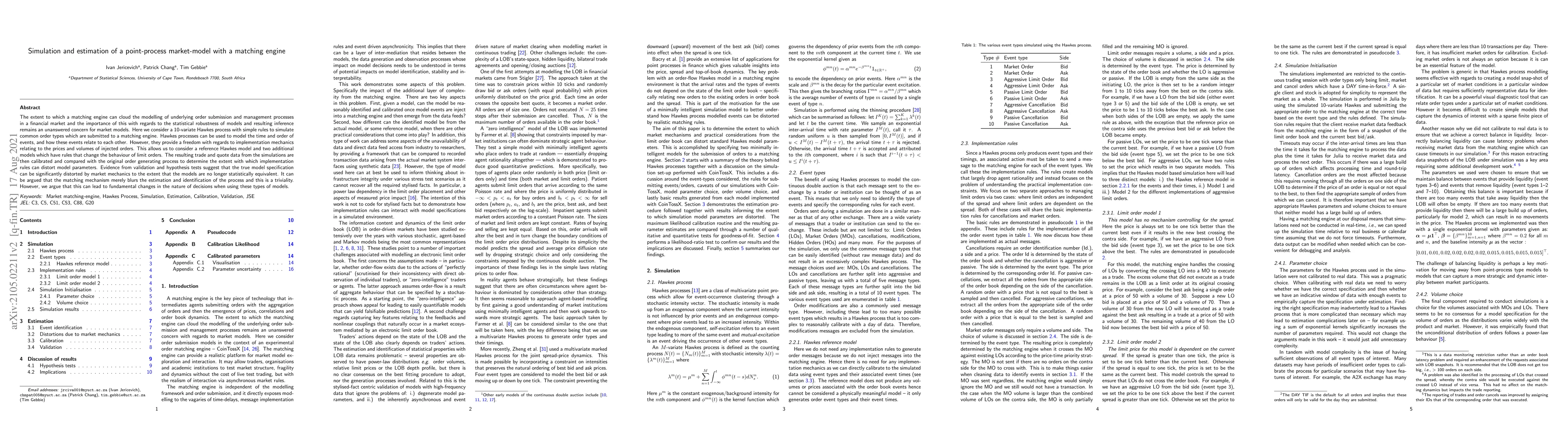

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarS: a Financial Market Simulation Engine Powered by Generative Foundation Model

Yang Liu, Weiqing Liu, Jiang Bian et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)