Summary

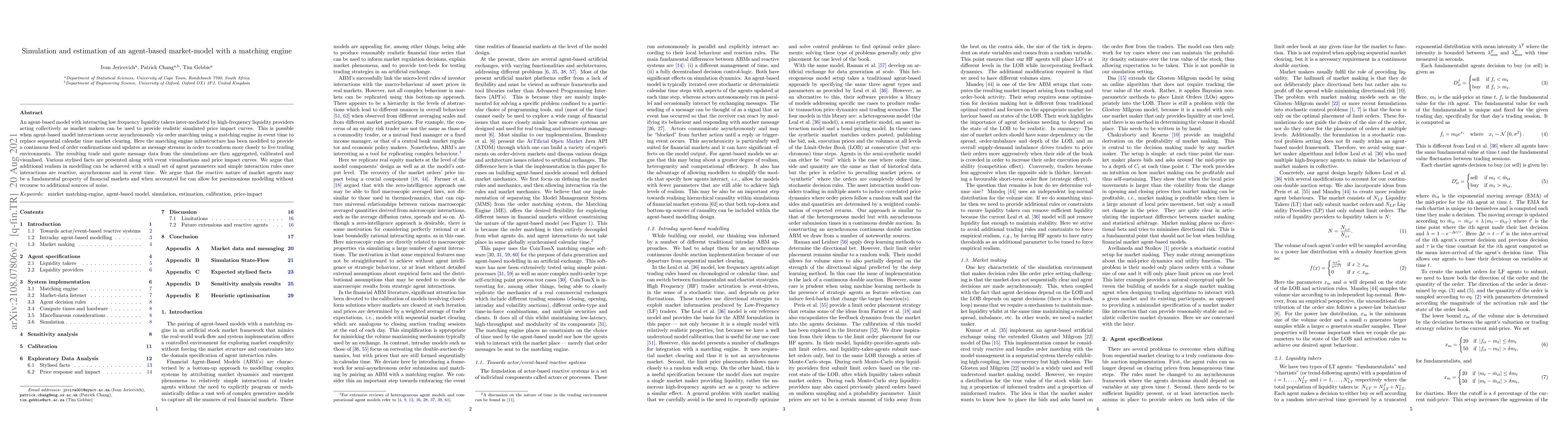

An agent-based model with interacting low frequency liquidity takers inter-mediated by high-frequency liquidity providers acting collectively as market makers can be used to provide realistic simulated price impact curves. This is possible when agent-based model interactions occur asynchronously via order matching using a matching engine in event time to replace sequential calendar time market clearing. Here the matching engine infrastructure has been modified to provide a continuous feed of order confirmations and updates as message streams in order to conform more closely to live trading environments. The resulting trade and quote message data from the simulations are then aggregated, calibrated and visualised. Various stylised facts are presented along with event visualisations and price impact curves. We argue that additional realism in modelling can be achieved with a small set of agent parameters and simple interaction rules once interactions are reactive, asynchronous and in event time. We argue that the reactive nature of market agents may be a fundamental property of financial markets and when accounted for can allow for parsimonious modelling without recourse to additional sources of noise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA simple learning agent interacting with an agent-based market model

Tim Gebbie, Matthew Dicks, Andrew Paskaramoorthy

MarS: a Financial Market Simulation Engine Powered by Generative Foundation Model

Yang Liu, Weiqing Liu, Jiang Bian et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)