Authors

Summary

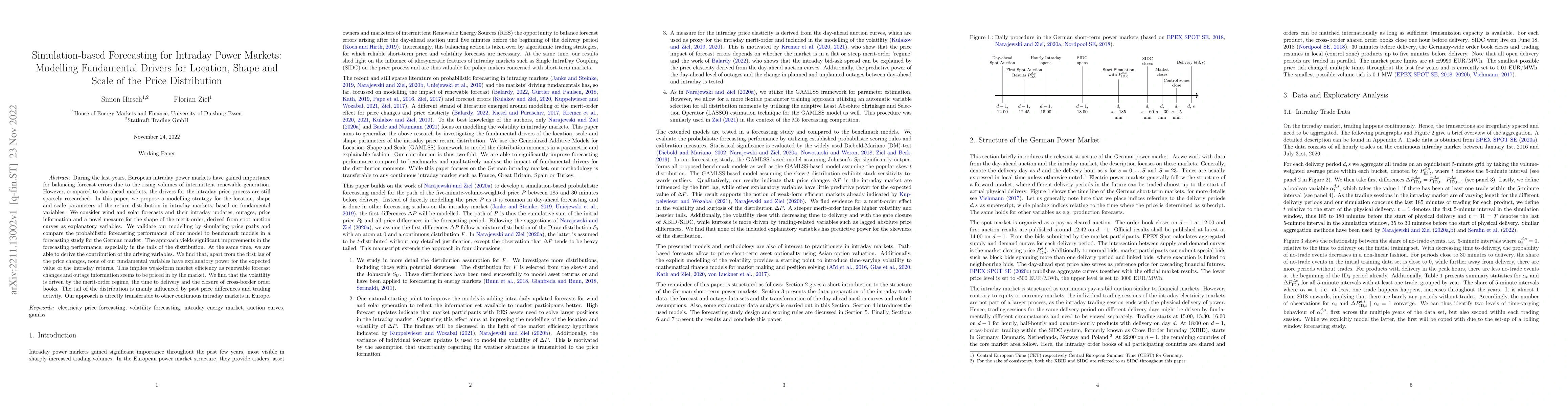

During the last years, European intraday power markets have gained importance for balancing forecast errors due to the rising volumes of intermittent renewable generation. However, compared to day-ahead markets, the drivers for the intraday price process are still sparsely researched. In this paper, we propose a modelling strategy for the location, shape and scale parameters of the return distribution in intraday markets, based on fundamental variables. We consider wind and solar forecasts and their intraday updates, outages, price information and a novel measure for the shape of the merit-order, derived from spot auction curves as explanatory variables. We validate our modelling by simulating price paths and compare the probabilistic forecasting performance of our model to benchmark models in a forecasting study for the German market. The approach yields significant improvements in the forecasting performance, especially in the tails of the distribution. At the same time, we are able to derive the contribution of the driving variables. We find that, apart from the first lag of the price changes, none of our fundamental variables have explanatory power for the expected value of the intraday returns. This implies weak-form market efficiency as renewable forecast changes and outage information seems to be priced in by the market. We find that the volatility is driven by the merit-order regime, the time to delivery and the closure of cross-border order books. The tail of the distribution is mainly influenced by past price differences and trading activity. Our approach is directly transferable to other continuous intraday markets in Europe.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Simulation-based Forecasting for Intraday Power Markets: Modelling Cross-Product Price Effects

Simon Hirsch, Florian Ziel

Representative electricity price profiles for European day-ahead and intraday spot markets

Alexander Mitsos, Chrysanthi Papadimitriou, Jan C. Schulze

| Title | Authors | Year | Actions |

|---|

Comments (0)