Summary

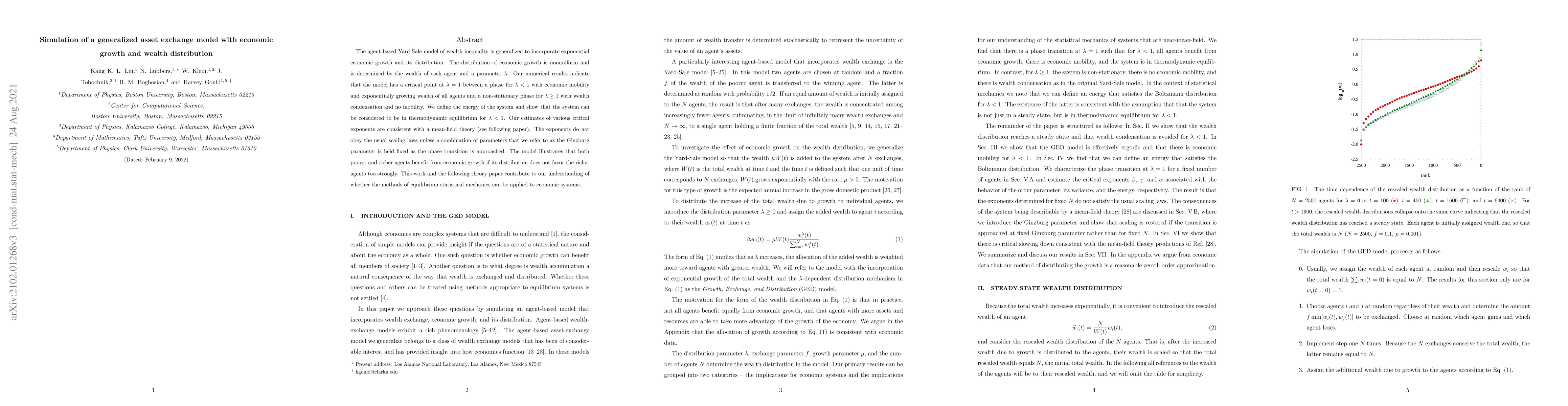

The agent-based Yard-Sale model of wealth inequality is generalized to incorporate exponential economic growth and its distribution. The distribution of economic growth is nonuniform and is determined by the wealth of each agent and a parameter $\lambda$. Our numerical results indicate that the model has a critical point at $\lambda=1$ between a phase for $\lambda < 1$ with economic mobility and exponentially growing wealth of all agents and a non-stationary phase for $\lambda \geq 1$ with wealth condensation and no mobility. We define the energy of the system and show that the system can be considered to be in thermodynamic equilibrium for $\lambda < 1$. Our estimates of various critical exponents are consistent with a mean-field theory (see following paper). The exponents do not obey the usual scaling laws unless a combination of parameters that we refer to as the Ginzburg parameter is held fixed as the transition is approached. The model illustrates that both poorer and richer agents benefit from economic growth if its distribution does not favor the richer agents too strongly. This work and the accompanying theory paper contribute to understanding whether the methods of equilibrium statistical mechanics can be applied to economic systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)