Authors

Summary

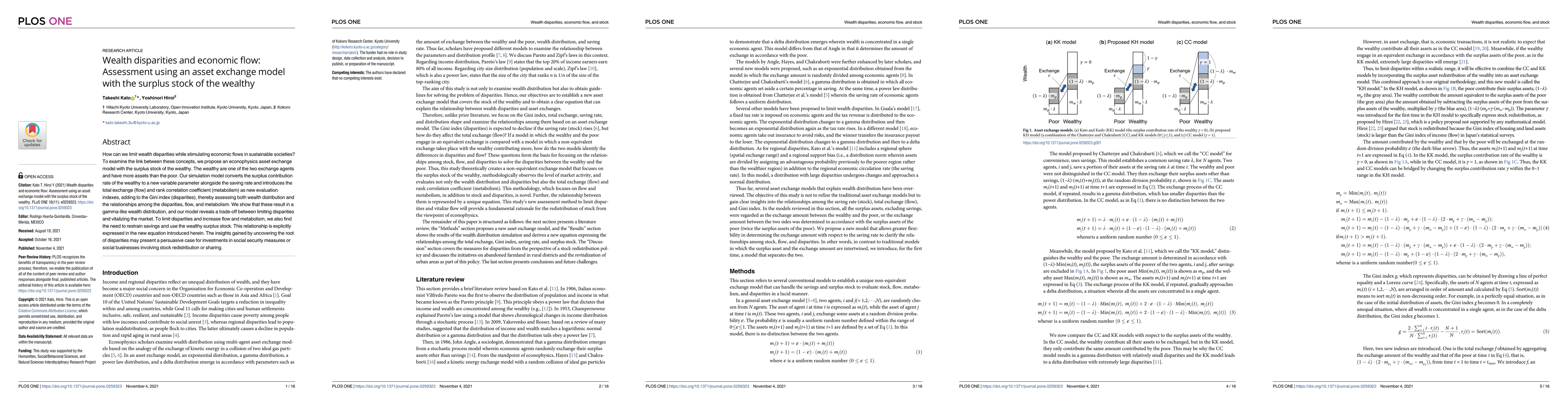

How can we limit wealth disparities while stimulating economic flows in sustainable societies? To examine the link between these concepts, we propose an econophysics asset exchange model with the surplus stock of the wealthy. The wealthy are one of the two exchange agents and have more assets than the poor. Our simulation model converts the surplus contribution rate of the wealthy to a new variable parameter alongside the saving rate and introduces the total exchange (flow) and rank correlation coefficient (metabolism) as new evaluation indexes, adding to the Gini index (disparities), thereby assessing both wealth distribution and the relationships among the disparities, flow, and metabolism. We show that these result in a gamma-like wealth distribution, and our model reveals a trade-off between limiting disparities and vitalizing the market. To limit disparities and increase flow and metabolism, we also find the need to restrain savings and use the wealthy surplus stock. This relationship is explicitly expressed in the new equation introduced herein. The insights gained by uncovering the root of disparities may present a persuasive case for investments in social security measures or social businesses involving stock redistribution or sharing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)