Authors

Summary

Exact simulation schemes under the Heston stochastic volatility model (e.g., Broadie-Kaya and Glasserman-Kim) suffer from computationally expensive modified Bessel function evaluations. We propose a new exact simulation scheme without the modified Bessel function, based on the observation that the conditional integrated variance can be simplified when conditioned by the Poisson variate used for simulating the terminal variance. Our approach also enhances the low-bias and time discretization schemes, which are suitable for pricing derivatives with frequent monitoring. Extensive numerical tests reveal the good performance of the new simulation schemes in terms of accuracy, efficiency, and reliability when compared with existing methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

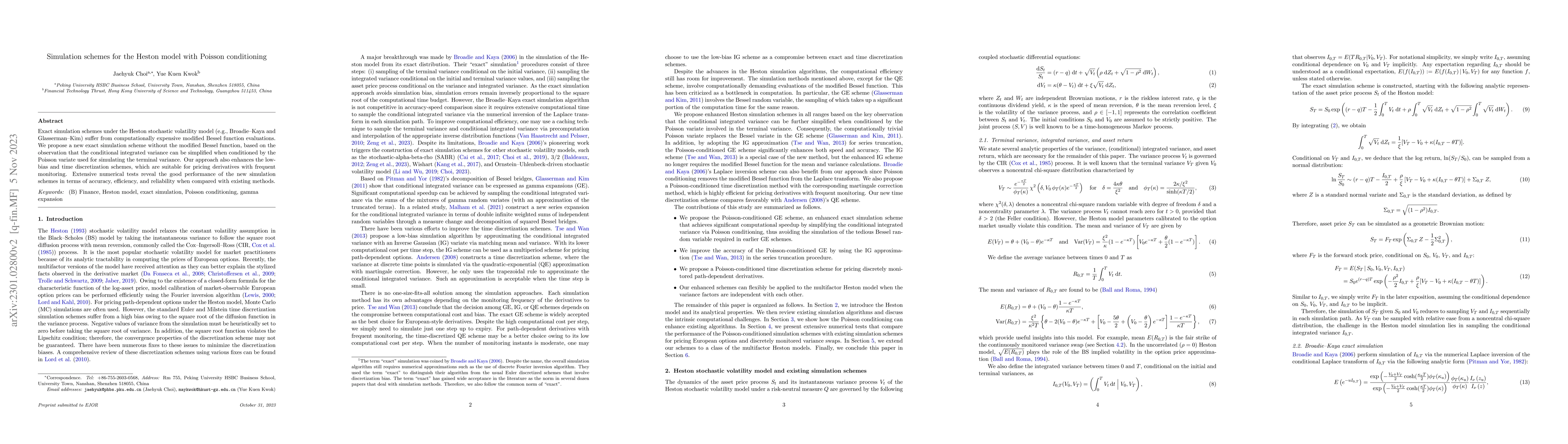

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient option pricing in the rough Heston model using weak simulation schemes

Christian Bayer, Simon Breneis

High order approximations and simulation schemes for the log-Heston process

Aurélien Alfonsi, Edoardo Lombardo

| Title | Authors | Year | Actions |

|---|

Comments (0)