Summary

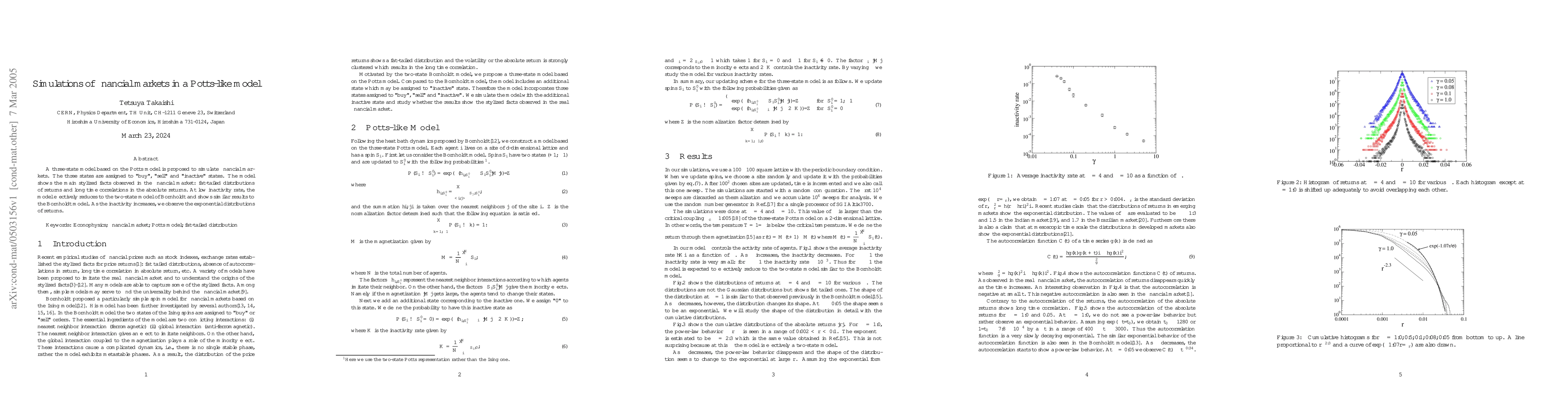

A three-state model based on the Potts model is proposed to simulate financial markets. The three states are assigned to "buy", "sell" and "inactive" states. The model shows the main stylized facts observed in the financial market: fat-tailed distributions of returns and long time correlations in the absolute returns. At low inactivity rate, the model effectively reduces to the two-state model of Bornholdt and shows similar results to the Bornholdt model. As the inactivity increases, we observe the exponential distributions of returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)