Summary

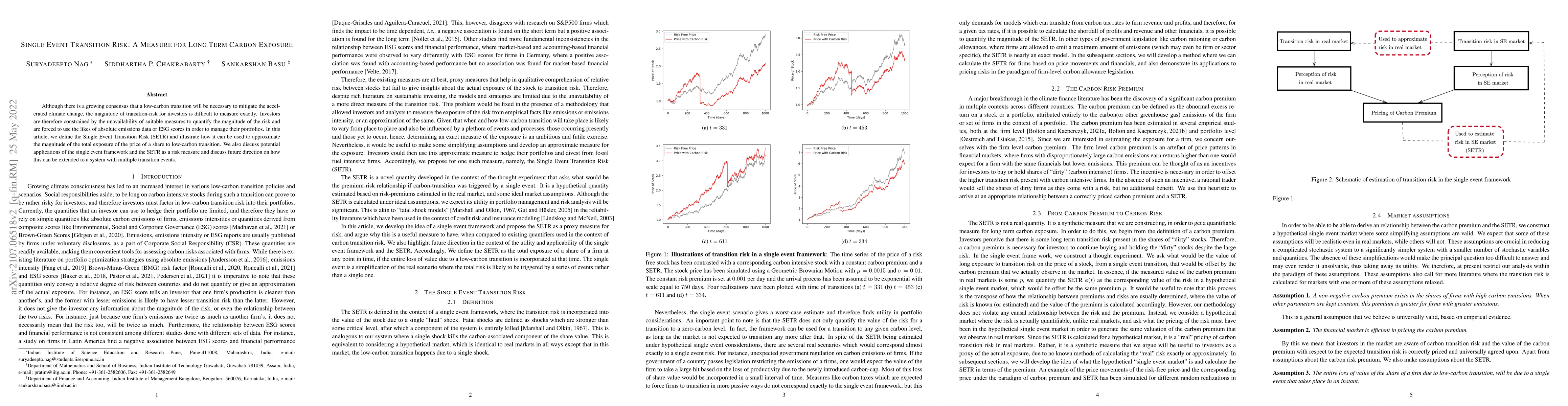

Although there is a growing consensus that a low-carbon transition will be necessary to mitigate the accelerated climate change, the magnitude of transition-risk for investors is difficult to measure exactly. Investors are therefore constrained by the unavailability of suitable measures to quantify the magnitude of the risk and are forced to use the likes of absolute emissions data or ESG scores in order to manage their portfolios. In this article, we define the Single Event Transition Risk (SETR) and illustrate how it can be used to approximate the magnitude of the total exposure of the price of a share to low-carbon transition. We also discuss potential applications of the single event framework and the SETR as a risk measure and discuss future direction on how this can be extended to a system with multiple transition events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLong-term exposure to elemental carbon and disease incidence: a systematic review and meta-analysis.

Kasdagli, Maria-Iosifina, Stamatiou, Dimitris, Analitis, Antonis et al.

Long-term PM2.5 components exposure, genetic susceptibility, and myocardial infarction risk.

Yang, Jian, Zhang, Jing, Chen, Ning et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)