Summary

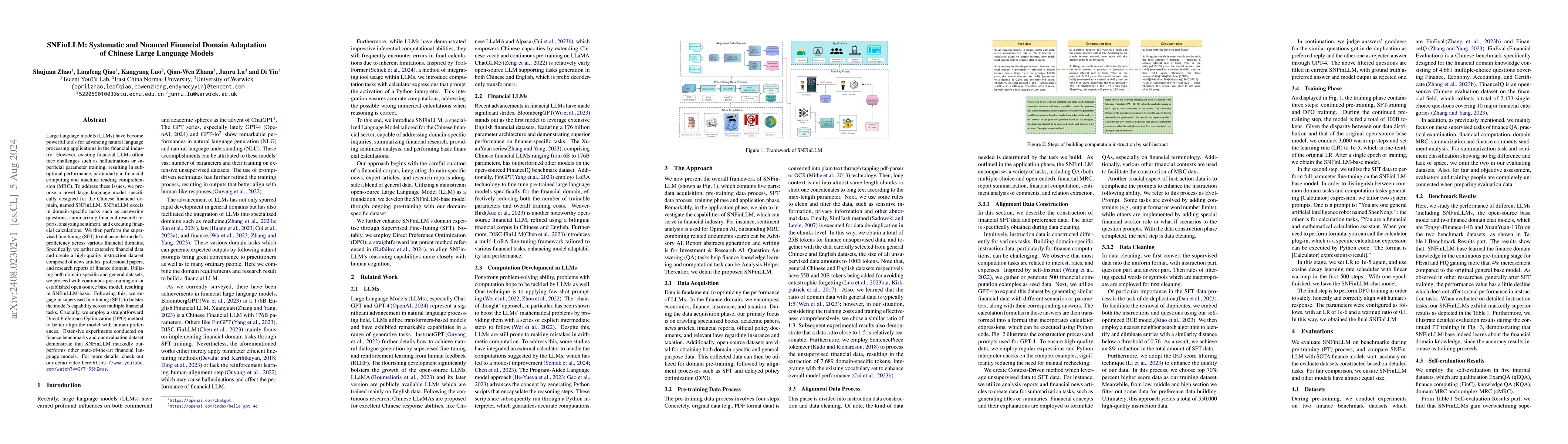

Large language models (LLMs) have become powerful tools for advancing natural language processing applications in the financial industry. However, existing financial LLMs often face challenges such as hallucinations or superficial parameter training, resulting in suboptimal performance, particularly in financial computing and machine reading comprehension (MRC). To address these issues, we propose a novel large language model specifically designed for the Chinese financial domain, named SNFinLLM. SNFinLLM excels in domain-specific tasks such as answering questions, summarizing financial research reports, analyzing sentiment, and executing financial calculations. We then perform the supervised fine-tuning (SFT) to enhance the model's proficiency across various financial domains. Specifically, we gather extensive financial data and create a high-quality instruction dataset composed of news articles, professional papers, and research reports of finance domain. Utilizing both domain-specific and general datasets, we proceed with continuous pre-training on an established open-source base model, resulting in SNFinLLM-base. Following this, we engage in supervised fine-tuning (SFT) to bolster the model's capability across multiple financial tasks. Crucially, we employ a straightforward Direct Preference Optimization (DPO) method to better align the model with human preferences. Extensive experiments conducted on finance benchmarks and our evaluation dataset demonstrate that SNFinLLM markedly outperforms other state-of-the-art financial language models. For more details, check out our demo video here: https://www.youtube.com/watch?v=GYT-65HZwus.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Domain Adaptation of Language Models via Model Augmentation

Hiroki Sakaji, Masanori Hirano, Kentaro Imajo et al.

FinEval: A Chinese Financial Domain Knowledge Evaluation Benchmark for Large Language Models

Xin Guo, Zhongyu Wei, Zhi Yang et al.

CFinBench: A Comprehensive Chinese Financial Benchmark for Large Language Models

Dacheng Tao, Wei He, Haoyu Wang et al.

Chinese Fine-Grained Financial Sentiment Analysis with Large Language Models

Wang Xu, Yanru Wu, Yinyu Lan et al.

No citations found for this paper.

Comments (0)