Summary

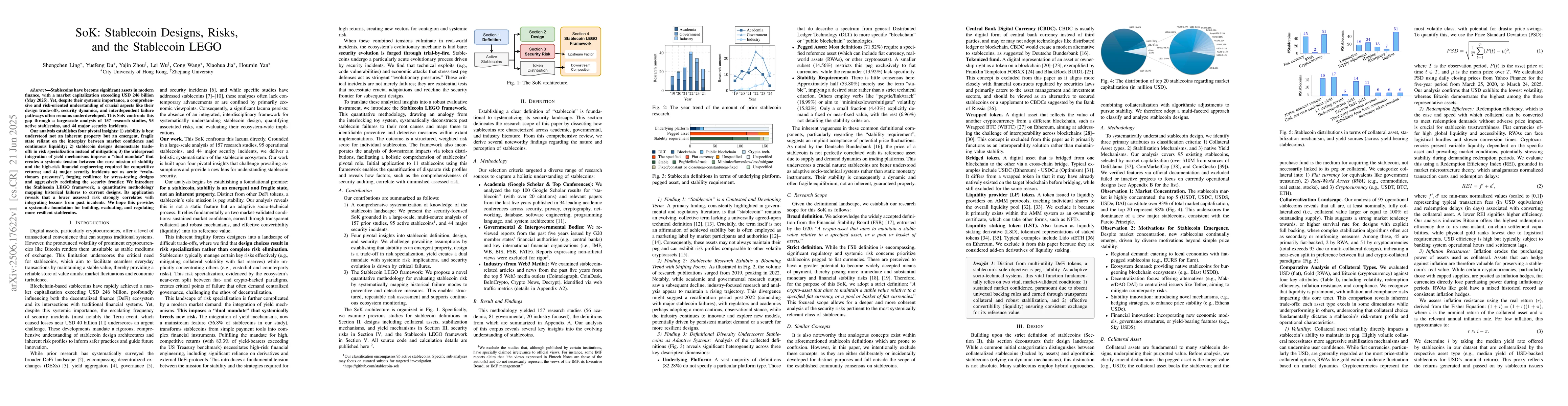

Stablecoins have become significant assets in modern finance, with a market capitalization exceeding USD 246 billion (May 2025). Yet, despite their systemic importance, a comprehensive and risk-oriented understanding of crucial aspects like their design trade-offs, security dynamics, and interdependent failure pathways often remains underdeveloped. This SoK confronts this gap through a large-scale analysis of 157 research studies, 95 active stablecoins, and 44 major security incidents. Our analysis establishes four pivotal insights: 1) stability is best understood not an inherent property but an emergent, fragile state reliant on the interplay between market confidence and continuous liquidity; 2) stablecoin designs demonstrate trade-offs in risk specialization instead of mitigation; 3) the widespread integration of yield mechanisms imposes a "dual mandate" that creates a systemic tension between the core mission of stability and the high-risk financial engineering required for competitive returns; and 4) major security incidents act as acute "evolutionary pressures", forging resilience by stress-testing designs and aggressively redefining the security frontier. We introduce the Stablecoin LEGO framework, a quantitative methodology mapping historical failures to current designs. Its application reveals that a lower assessed risk strongly correlates with integrating lessons from past incidents. We hope this provides a systematic foundation for building, evaluating, and regulating more resilient stablecoins.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCroCoDai: A Stablecoin for Cross-Chain Commerce

Anwitaman Datta, Daniël Reijsbergen, Bretislav Hajek et al.

JANUS: A Stablecoin 3.0 Blueprint for Navigating the Stablecoin Trilemma Through Dual-Token Design, Multi-Collateralization, Soft Peg, and AI-Driven Stabilization

Stylianos Kampakis

What Drives the (In)stability of a Stablecoin?

Dawn Song, Christine Parlour, Philipp Jovanovic et al.

No citations found for this paper.

Comments (0)