Summary

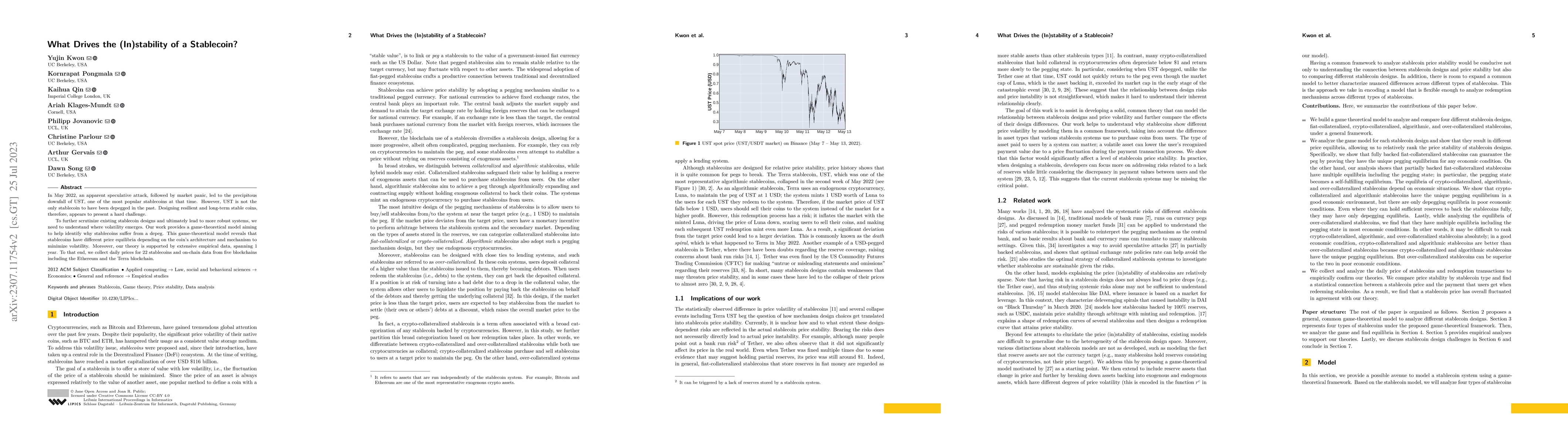

In May 2022, an apparent speculative attack, followed by market panic, led to the precipitous downfall of UST, one of the most popular stablecoins at that time. However, UST is not the only stablecoin to have been depegged in the past. Designing resilient and long-term stable coins, therefore, appears to present a hard challenge. To further scrutinize existing stablecoin designs and ultimately lead to more robust systems, we need to understand where volatility emerges. Our work provides a game-theoretical model aiming to help identify why stablecoins suffer from a depeg. This game-theoretical model reveals that stablecoins have different price equilibria depending on the coin's architecture and mechanism to minimize volatility. Moreover, our theory is supported by extensive empirical data, spanning $1$ year. To that end, we collect daily prices for 22 stablecoins and on-chain data from five blockchains including the Ethereum and the Terra blockchain.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers(In)Stability for the Blockchain: Deleveraging Spirals and Stablecoin Attacks

Andreea Minca, Ariah Klages-Mundt

SoK: Stablecoin Designs, Risks, and the Stablecoin LEGO

Cong Wang, Lei Wu, Yajin Zhou et al.

JANUS: A Stablecoin 3.0 Blueprint for Navigating the Stablecoin Trilemma Through Dual-Token Design, Multi-Collateralization, Soft Peg, and AI-Driven Stabilization

Stylianos Kampakis

Designing Autonomous Markets for Stablecoin Monetary Policy

Ariah Klages-Mundt, Steffen Schuldenzucker

| Title | Authors | Year | Actions |

|---|

Comments (0)