Authors

Summary

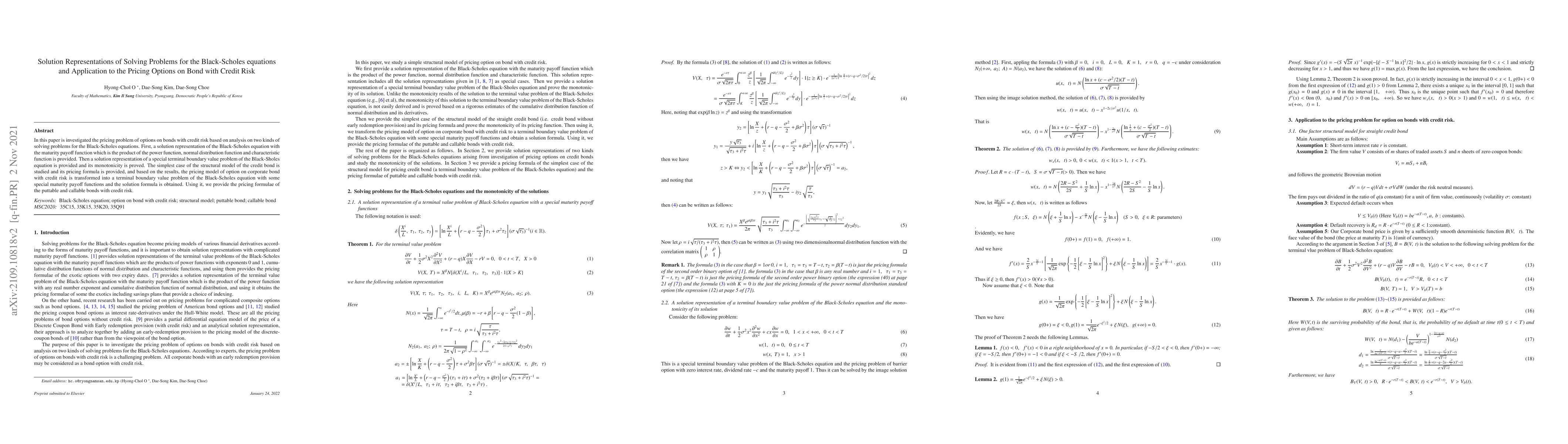

In this paper is investigated the pricing problem of options on bonds with credit risk based on analysis on two kinds of solving problems for the Black-Scholes equations. First, a solution representation of the Black-Scholes equation with the maturity payoff function which is the product of the power function, normal distribution function and characteristic function is provided. Then a solution representation of a special terminal boundary value problem of the Black-Sholes equation is provided and its monotonicity is proved. The simplest case of the structural model of the credit bond is studied and its pricing formula is provided, and based on the results, the pricing model of option on corporate bond with credit risk is transformed into a terminal boundary value problem of the Black-Scholes equation with some special maturity payoff functions and the solution formula is obtained. Using it, we provide the pricing formulae of the puttable and callable bonds with credit risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytical Pricing of 2 Factor Structural PDE model for a Puttable Bond with Credit Risk

Hyong Chol O, Dae Song Choe, Gyong-Dok Rim

| Title | Authors | Year | Actions |

|---|

Comments (0)