Authors

Summary

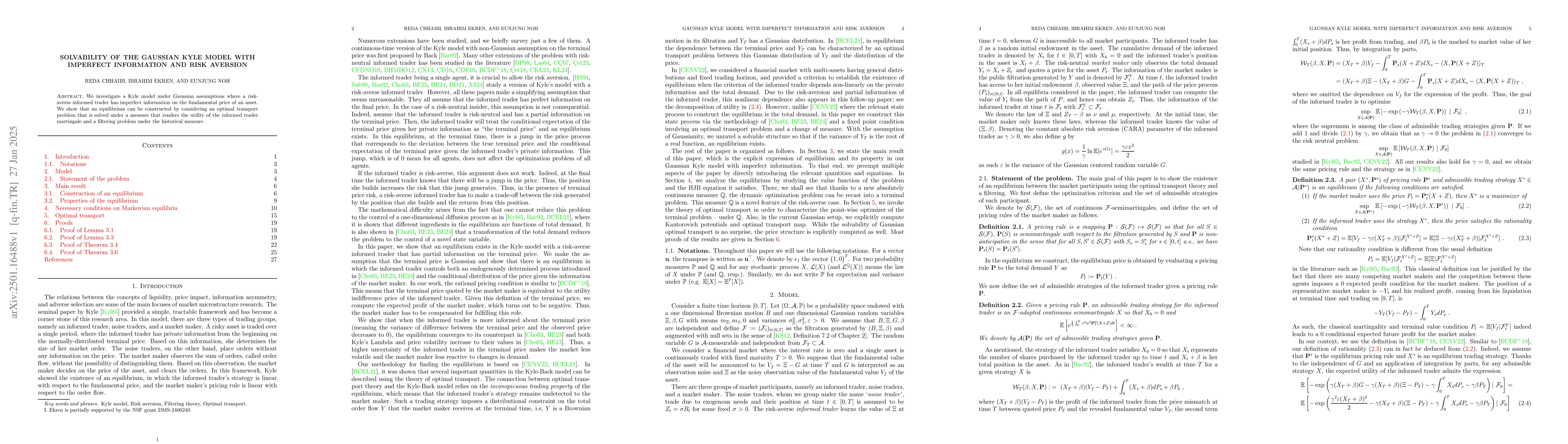

We investigate a Kyle model under Gaussian assumptions where a risk-averse informed trader has imperfect information on the fundamental price of an asset. We show that an equilibrium can be constructed by considering an optimal transport problem that is solved under a measure that renders the utility of the informed trader martingale and a filtering problem under the historical measure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersKyle-Back Models with risk aversion and non-Gaussian Beliefs

Ibrahim Ekren, Shreya Bose

No citations found for this paper.

Comments (0)