Summary

The volatility fitting is one of the core problems in the equity derivatives business. Through a set of deterministic rules, the degrees of freedom in the implied volatility surface encoding (parametrization, density, diffusion) are defined. Whilst very effective, this approach widespread in the industry is not natively tailored to learn from shifts in market regimes and discover unsuspected optimal behaviors. In this paper, we change the classical paradigm and apply the latest advances in Deep Reinforcement Learning(DRL) to solve the fitting problem. In particular, we show that variants of Deep Deterministic Policy Gradient (DDPG) and Soft Actor Critic (SAC) can achieve at least as good as standard fitting algorithms. Furthermore, we explain why the reinforcement learning framework is appropriate to handle complex objective functions and is natively adapted for online learning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

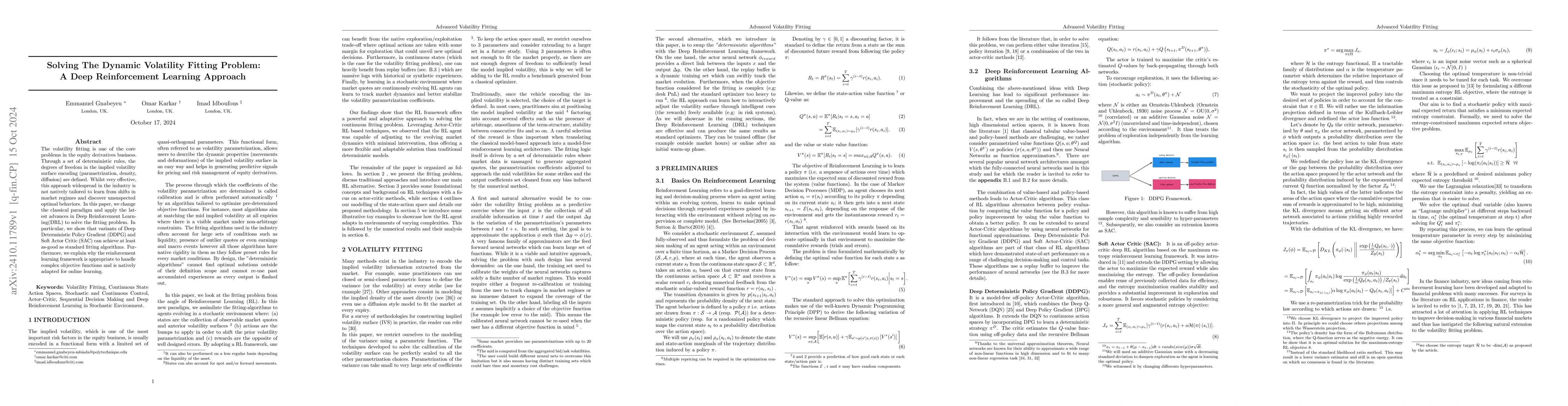

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSolving the Quadratic Assignment Problem using Deep Reinforcement Learning

Arthur Delarue, Puneet S. Bagga

Solving the flexible job-shop scheduling problem through an enhanced deep reinforcement learning approach

Roberto Santana, Imanol Echeverria, Maialen Murua

No citations found for this paper.

Comments (0)