Summary

We consider the problem of portfolio selection within the classical Markowitz mean-variance framework, reformulated as a constrained least-squares regression problem. We propose to add to the objective function a penalty proportional to the sum of the absolute values of the portfolio weights. This penalty regularizes (stabilizes) the optimization problem, encourages sparse portfolios (i.e. portfolios with only few active positions), and allows to account for transaction costs. Our approach recovers as special cases the no-short-positions portfolios, but does allow for short positions in limited number. We implement this methodology on two benchmark data sets constructed by Fama and French. Using only a modest amount of training data, we construct portfolios whose out-of-sample performance, as measured by Sharpe ratio, is consistently and significantly better than that of the naive evenly-weighted portfolio which constitutes, as shown in recent literature, a very tough benchmark.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research proposes a method for constructing sparse and stable portfolios by introducing an ℓ1 penalty in the Markowitz portfolio optimization. It presents an efficient algorithm for computing optimal, sparse portfolios and implements it using datasets from Fama and French: 48 industry portfolios and 100 portfolios formed on size and book-to-market.

Key Results

- Sparse portfolios outperform evenly-weighted portfolios by achieving smaller variance.

- The effect is observed over a range of values for the number of active positions, typically with a small number of assets.

- No-short-position portfolios are special cases of the proposed method, maintaining or improving performance while preserving sparsity.

- The method is empirically validated to outperform the 1/N benchmark strategy consistently over the entire evaluation period.

Significance

This research demonstrates that adding an ℓ1 penalty to objective functions is a powerful tool for various portfolio construction tasks, ensuring optimization selects a limited number of assets for stable and robust portfolios, mitigating issues caused by collinearity and estimation errors.

Technical Contribution

The paper introduces a constrained minimization algorithm for solving linearly constrained ℓ1-penalized least-squares problems, ensuring exact solutions and providing breakpoints (and minimizers) for a wide range of penalty parameter values.

Novelty

The research highlights a previously unnoticed sparsity property of non-negative portfolios, extending no-short-position portfolios while preserving their sparsity and performance, and proposes an efficient algorithm for computing optimal sparse portfolios.

Limitations

- The study is limited to the Markowitz mean-variance framework and does not explore other portfolio optimization methods.

- Empirical evidence is based on specific datasets from Fama and French, which may not generalize to all market conditions or asset classes.

- The paper does not address dynamic portfolio adjustments or real-time implementation challenges.

Future Work

- Extend empirical exercises to other and larger asset collections, such as S&P 500.

- Explore other performance criteria beyond the Sharpe ratio.

- Develop automatic procedures for choosing the number of assets in the portfolio.

Paper Details

PDF Preview

Key Terms

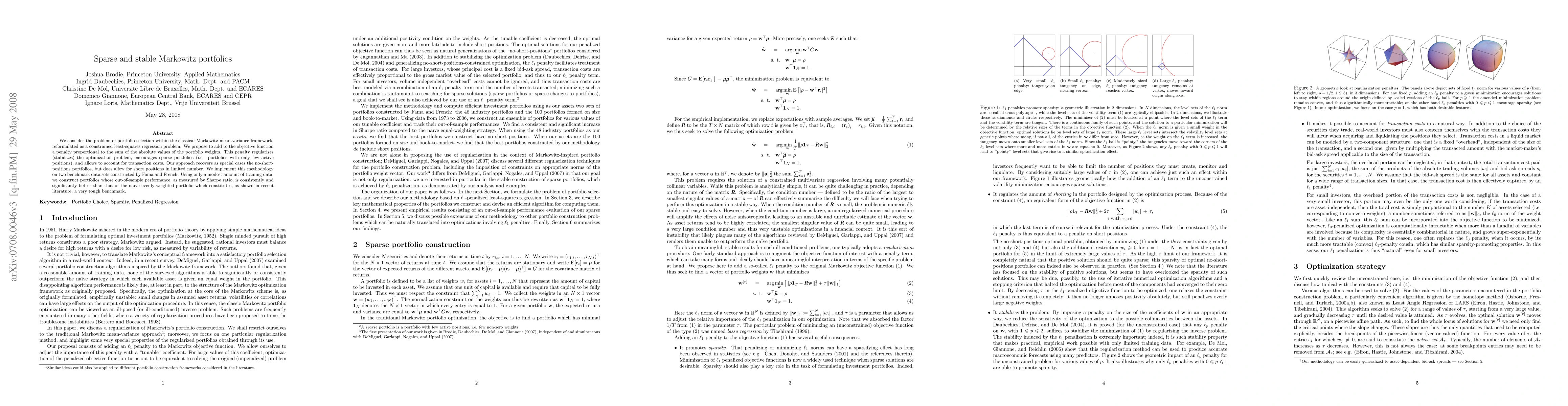

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimization of portfolios with cryptocurrencies: Markowitz and GARCH-Copula model approach

Vahidin Jeleskovic, Zahid I. Younas, Claudio Latini et al.

Robustifying Markowitz

Nikita Zhivotovskiy, Wolfgang Karl Härdle, Yegor Klochkov et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)