Summary

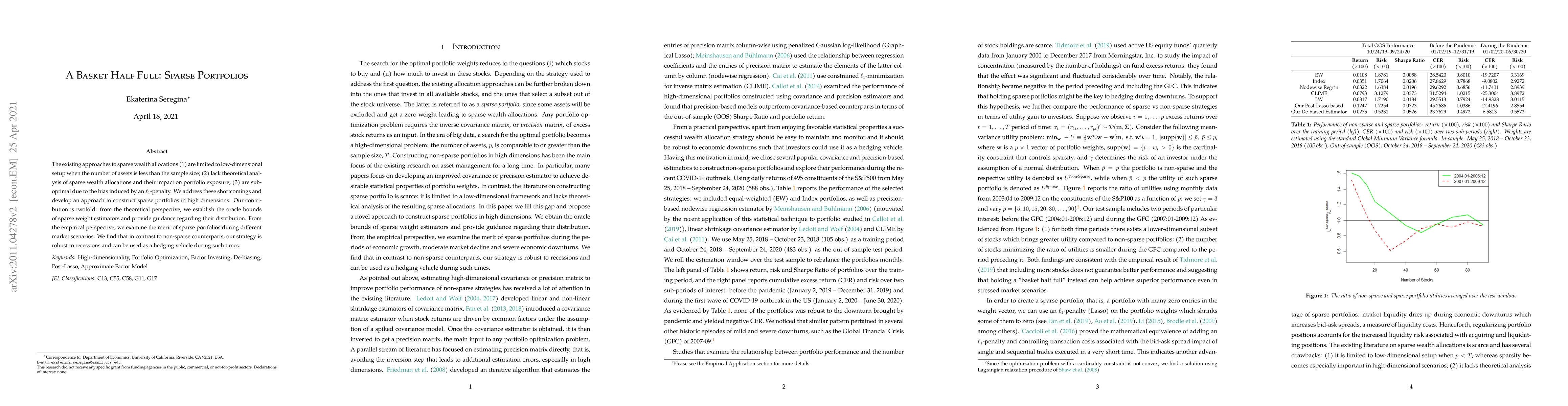

The existing approaches to sparse wealth allocations (1) are limited to low-dimensional setup when the number of assets is less than the sample size; (2) lack theoretical analysis of sparse wealth allocations and their impact on portfolio exposure; (3) are suboptimal due to the bias induced by an $\ell_1$-penalty. We address these shortcomings and develop an approach to construct sparse portfolios in high dimensions. Our contribution is twofold: from the theoretical perspective, we establish the oracle bounds of sparse weight estimators and provide guidance regarding their distribution. From the empirical perspective, we examine the merit of sparse portfolios during different market scenarios. We find that in contrast to non-sparse counterparts, our strategy is robust to recessions and can be used as a hedging vehicle during such times.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA new behavioral model for portfolio selection using the Half-Full/Half-Empty approach

Lorenzo Lampariello, Francesco Cesarone, Massimiliano Corradini et al.

Formulations to select assets for constructing sparse index tracking portfolios

Yutaka Sakurai, Daiki Wakabayashi, Fumio Ishizaki

No citations found for this paper.

Comments (0)