Summary

We focus on a behavioral model, that has been recently proposed in the literature, whose rational can be traced back to the Half-Full/Half-Empty glass metaphor. More precisely, we generalize the Half-Full/Half-Empty approach to the context of positive and negative lotteries and give financial and behavioral interpretations of the Half-Full/Half-Empty parameters. We develop a portfolio selection model based on the Half-Full/Half-Empty strategy, resulting in a nonconvex optimization problem, which, nonetheless, is proven to be equivalent to an alternative Mixed-Integer Linear Programming formulation. By means of the ensuing empirical analysis, based on three real-world datasets, the Half-Full/Half-Empty model is shown to be very versatile by appropriately varying its parameters, and to provide portfolios displaying promising performances in terms of risk and profitability, compared with Prospect Theory, risk minimization approaches and Equally-Weighted portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

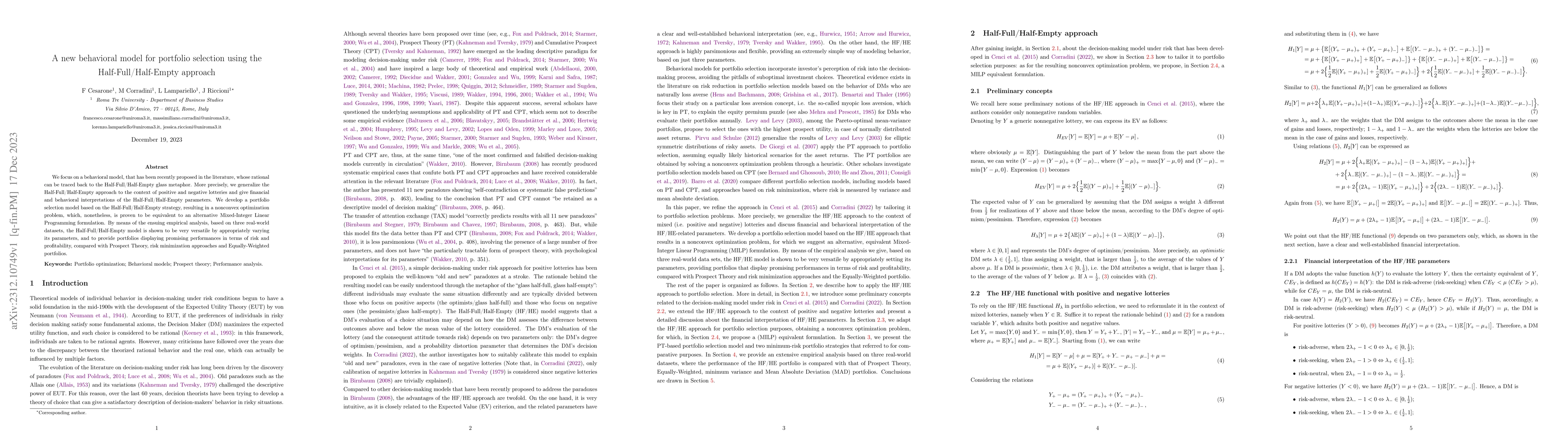

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClarifying the Half Full or Half Empty Question: Multimodal Container Classification

Stefan Wermter, Josua Spisak, Matthias Kerzel

No citations found for this paper.

Comments (0)