Summary

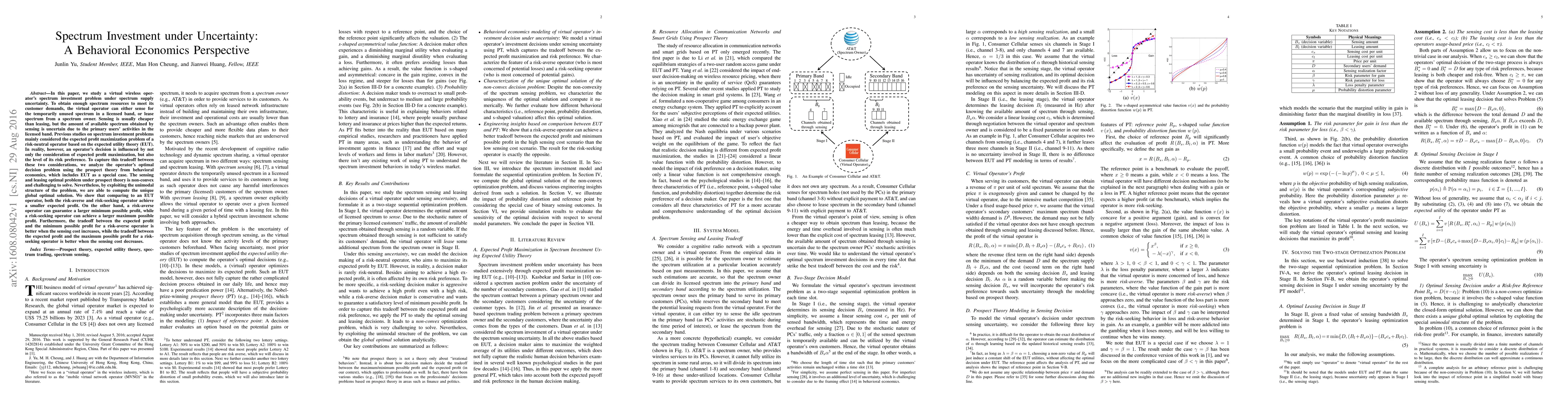

In this paper, we study a virtual wireless operator's spectrum investment problem under spectrum supply uncertainty. To obtain enough spectrum resources to meet its customer demands, the virtual operator can either sense for the temporarily unused spectrum in a licensed band, or lease spectrum from a spectrum owner. Sensing is usually cheaper than leasing, but the amount of available spectrum obtained by sensing is uncertain due to the primary users' activities in the licensed band. Previous studies on spectrum investment problems mainly considered the expected profit maximization problem of a risk-neutral operator based on the expected utility theory (EUT). In reality, however, an operator's decision is influenced by not only the consideration of expected profit maximization, but also the level of its risk preference. To capture this tradeoff between these two considerations, we analyze the operator's optimal decision problem using the prospect theory from behavioral economics, which includes EUT as a special case. The sensing and leasing optimal problem under prospect theory is non-convex and challenging to solve. Nevertheless, by exploiting the unimodal structure of the problem, we are able to compute the unique global optimal solution. We show that comparing to an EUT operator, both the risk-averse and risk-seeking operator achieve a smaller expected profit. On the other hand, a risk-averse operator can guarantee a larger minimum possible profit, while a risk-seeking operator can achieve a larger maximum possible profit. Furthermore, the tradeoff between the expected profit and the minimum possible profit for a risk-averse operator is better when the sensing cost increases, while the tradeoff between the expected profit and the maximum possible profit for a risk-seeking operator is better when the sensing cost decreases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)