Summary

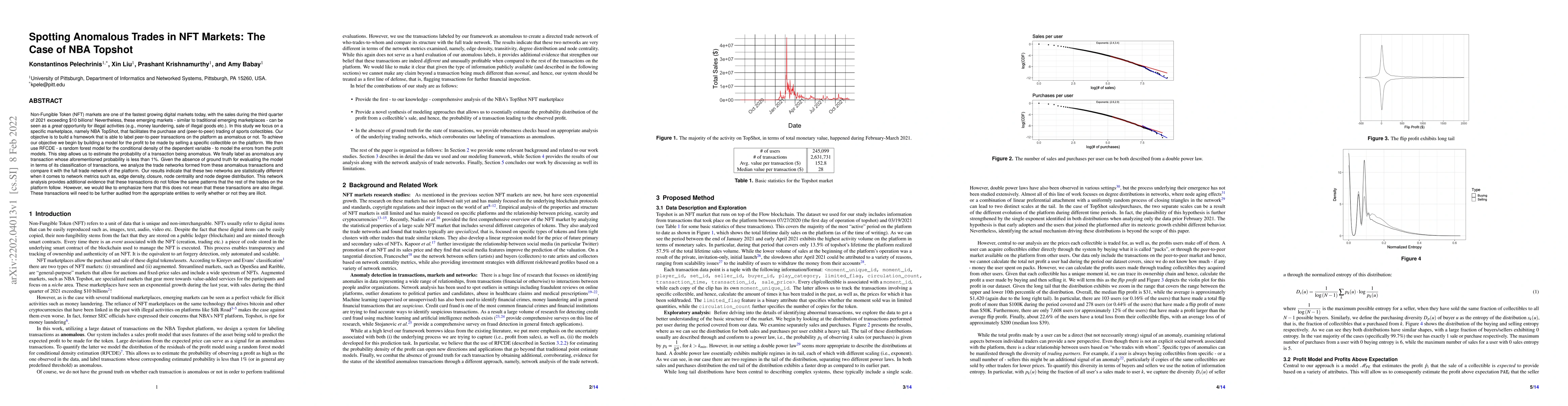

Non-Fungible Token (NFT) markets are one of the fastest growing digital markets today, with the sales during the third quarter of 2021 exceeding $10 billions! Nevertheless, these emerging markets - similar to traditional emerging marketplaces - can be seen as a great opportunity for illegal activities (e.g., money laundering, sale of illegal goods etc.). In this study we focus on a specific marketplace, namely NBA TopShot, that facilitates the purchase and (peer-to-peer) trading of sports collectibles. Our objective is to build a framework that is able to label peer-to-peer transactions on the platform as anomalous or not. To achieve our objective we begin by building a model for the profit to be made by selling a specific collectible on the platform. We then use RFCDE - a random forest model for the conditional density of the dependent variable - to model the errors from the profit models. This step allows us to estimate the probability of a transaction being anomalous. We finally label as anomalous any transaction whose aforementioned probability is less than 1%. Given the absence of ground truth for evaluating the model in terms of its classification of transactions, we analyze the trade networks formed from these anomalous transactions and compare it with the full trade network of the platform. Our results indicate that these two networks are statistically different when it comes to network metrics such as, edge density, closure, node centrality and node degree distribution. This network analysis provides additional evidence that these transactions do not follow the same patterns that the rest of the trades on the platform follow. However, we would like to emphasize here that this does not mean that these transactions are also illegal. These transactions will need to be further audited from the appropriate entities to verify whether or not they are illicit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnveiling Wash Trading in Popular NFT Markets

Xiaoqi Li, Wenkai Li, Hongli Peng et al.

NFTDisk: Visual Detection of Wash Trading in NFT Markets

Yong Wang, Min Zhu, Feida Zhu et al.

NFT Wash Trading: Quantifying suspicious behaviour in NFT markets

Omri Ross, Victor von Wachter, Johannes Rude Jensen et al.

Non-Markovian paths and cycles in NFT trades

Renaud Lambiotte, Naomi A. Arnold, Peijie Zhong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)