Authors

Summary

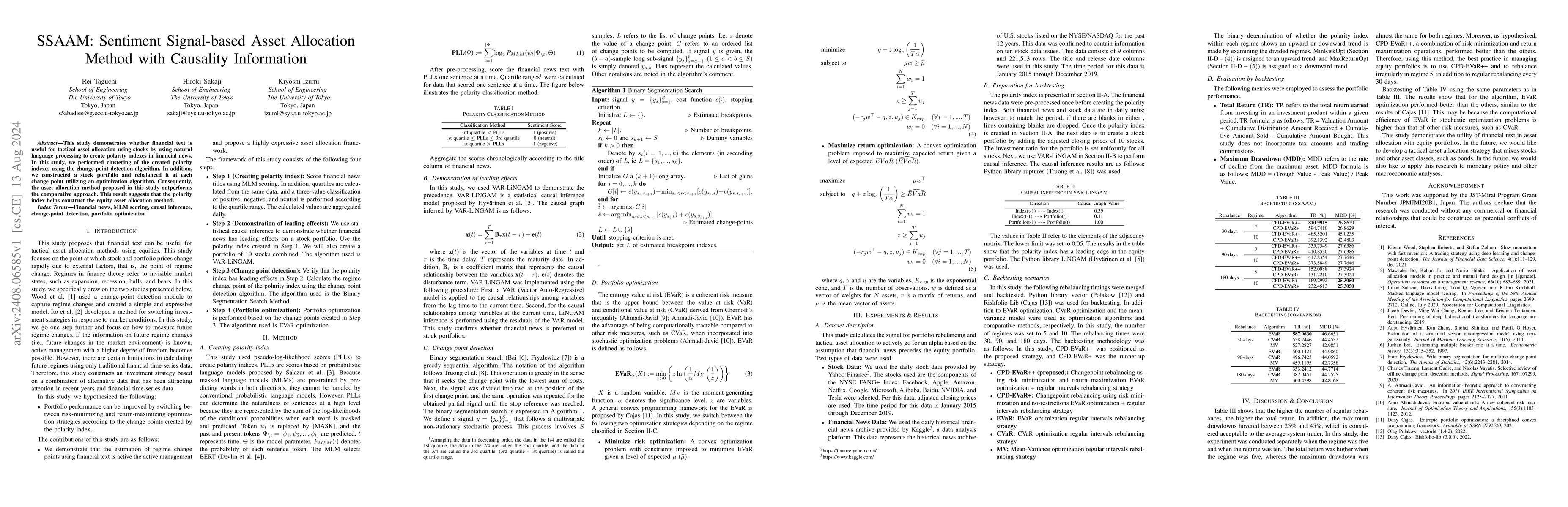

This study demonstrates whether financial text is useful for tactical asset allocation using stocks by using natural language processing to create polarity indexes in financial news. In this study, we performed clustering of the created polarity indexes using the change-point detection algorithm. In addition, we constructed a stock portfolio and rebalanced it at each change point utilizing an optimization algorithm. Consequently, the asset allocation method proposed in this study outperforms the comparative approach. This result suggests that the polarity index helps construct the equity asset allocation method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Modified CTGAN-Plus-Features Based Method for Optimal Asset Allocation

José-Manuel Peña, Fernando Suárez, Omar Larré et al.

Dynamic Asset Allocation with Asset-Specific Regime Forecasts

John M. Mulvey, Yizhan Shu, Chenyu Yu

Strategic Asset Allocation with Illiquid Alternatives

Stephen Boyd, Mykel Kochenderfer, Wen Cao et al.

Portfolio Transformer for Attention-Based Asset Allocation

Denise Gorse, Damian Kisiel

No citations found for this paper.

Comments (0)