Summary

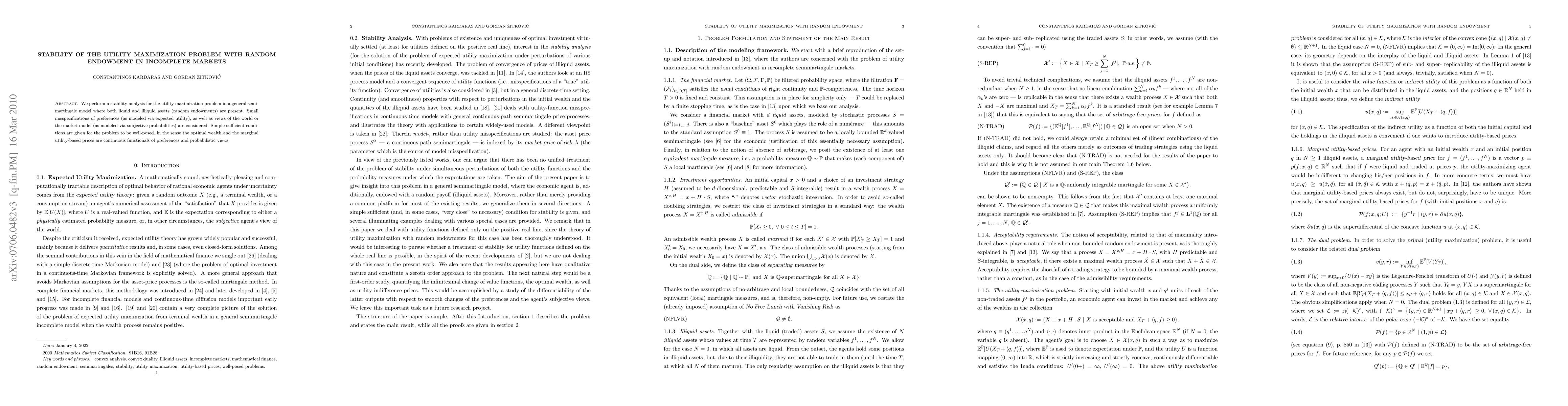

We perform a stability analysis for the utility maximization problem in a general semimartingale model where both liquid and illiquid assets (random endowments) are present. Small misspecifications of preferences (as modeled via expected utility), as well as views of the world or the market model (as modeled via subjective probabilities) are considered. Simple sufficient conditions are given for the problem to be well-posed, in the sense the optimal wealth and the marginal utility-based prices are continuous functionals of preferences and probabilistic views.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)