Summary

The optimization criterion for dividends from a risky business is most often formalized in terms of the expected present value of future dividends. That criterion disregards a potential, explicit demand for stability of dividends. In particular, within actuarial risk theory, maximization of future dividends have been intensively studied as the so-called de Finetti problem. However, there the optimal strategies typically become so-called barrier strategies. These are far from stable and suboptimal affine dividend strategies have therefore received attention recently. In contrast, in the class of linear-quadratic problems a demand for stability if explicitly stressed. These have most often been studied in diffusion models different from the actuarial risk models. We bridge the gap between these patterns of thinking by deriving optimal affine dividend strategies under a linear-quadratic criterion for a general L\'evy process. We characterize the value function by the Hamilton-Jacobi-Bellman equation, solve it, and compare the objective and the optimal controls to the classical objective of maximizing expected present value of future dividends. Thereby we provide a framework within which stability of dividends from a risky business, as e.g. in classical risk theory, is explicitly demanded and explicitly obtained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

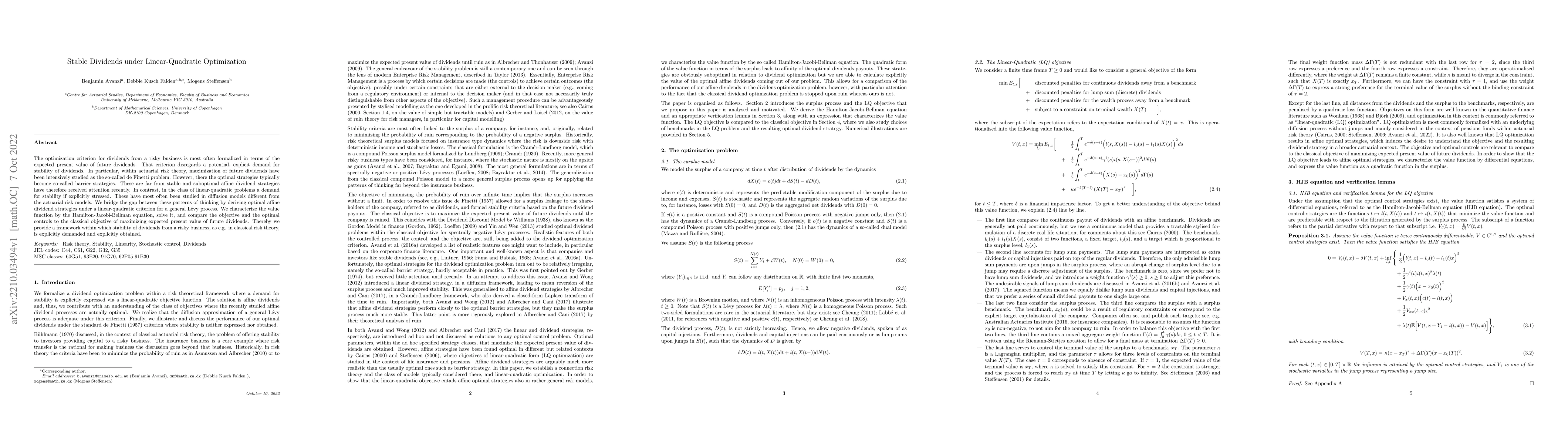

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStable Linear System Identification with Prior Knowledge by Riemannian Sequential Quadratic Optimization

Akiko Takeda, Takayuki Okuno, Kazuhiro Sato et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)