Authors

Summary

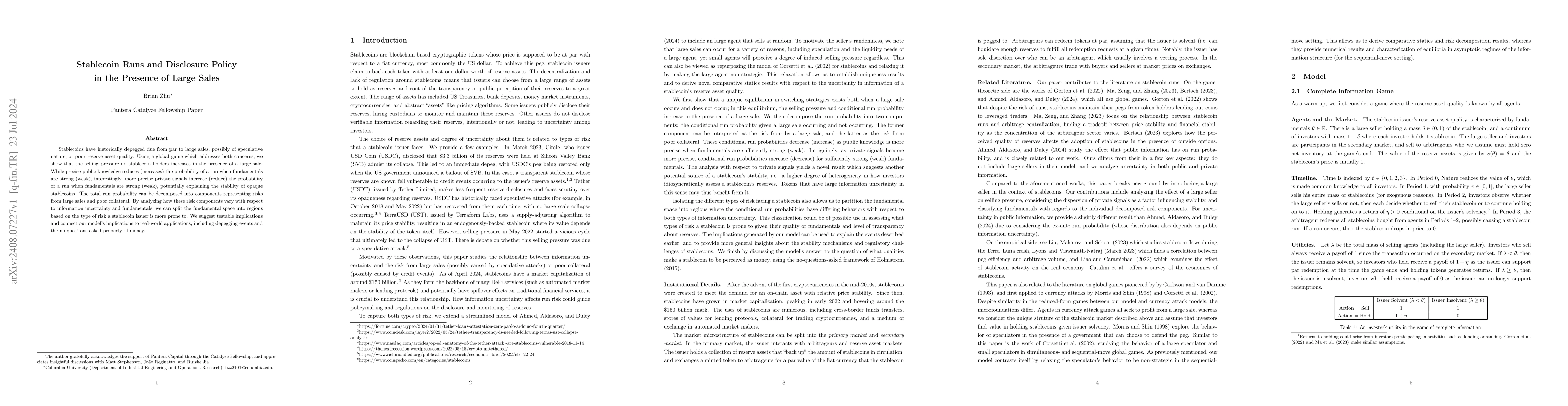

Stablecoins have historically depegged due from par to large sales, possibly of speculative nature, or poor reserve asset quality. Using a global game which addresses both concerns, we show that the selling pressure on stablecoin holders increases in the presence of a large sale. While precise public knowledge reduces (increases) the probability of a run when fundamentals are strong (weak), interestingly, more precise private signals increase (reduce) the probability of a run when fundamentals are strong (weak), potentially explaining the stability of opaque stablecoins. The total run probability can be decomposed into components representing risks from large sales and poor collateral. By analyzing how these risk components vary with respect to information uncertainty and fundamentals, we can split the fundamental space into regions based on the type of risk a stablecoin issuer is more prone to. We suggest testable implications and connect our model's implications to real-world applications, including depegging events and the no-questions-asked property of money.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDesigning Autonomous Markets for Stablecoin Monetary Policy

Ariah Klages-Mundt, Steffen Schuldenzucker

SoK: Stablecoin Designs, Risks, and the Stablecoin LEGO

Cong Wang, Lei Wu, Yajin Zhou et al.

No citations found for this paper.

Comments (0)