Authors

Summary

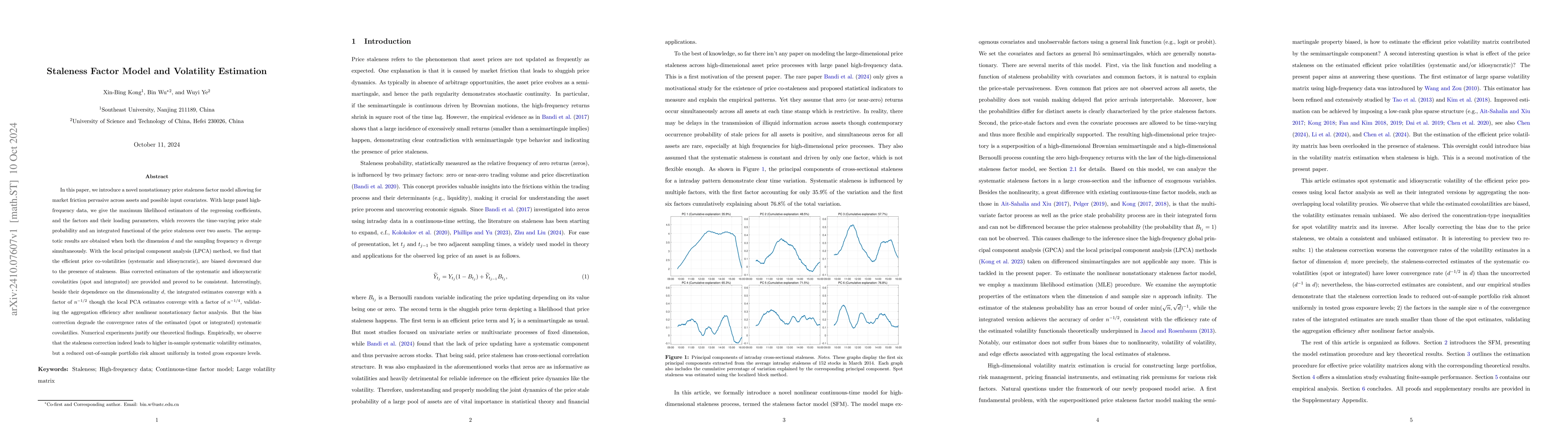

In this paper, we introduce a novel nonstationary price staleness factor model allowing for market friction pervasive across assets and possible input covariates. With large panel high-frequency data, we give the maximum likelihood estimators of the regressing coefficients, and the factors and their loading parameters, which recovers the time-varying price stale probability and an integrated functional of the price staleness over two assets. The asymptotic results are obtained when both the dimension $d$ and the sampling frequency $n$ diverge simultaneously. With the local principal component analysis (LPCA) method, we find that the efficient price co-volatilities (systematic and idiosyncratic), are biased downward due to the presence of staleness. Bias corrected estimators of the systematic and idiosyncratic covolatities (spot and integrated) are provided and proved to be consistent. Interestingly, beside their dependence on the dimensionality $d$, the integrated estimates converge with a factor of $n^{-1/2}$ though the local PCA estimates converge with a factor of $n^{-1/4}$, validating the aggregation efficiency after nonlinear nonstationary factor analysis. But the bias correction degrade the convergence rates of the estimated (spot or integrated) systematic covolatilies. Numerical experiments justify our theoretical findings. Empirically, we observe that the staleness correction indeed leads to higher in-sample systematic volatility estimates, but a reduced out-of-sample portfolio risk almost uniformly in tested gross exposure levels.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSequential Estimation of Multivariate Factor Stochastic Volatility Models

Roxana Halbleib, Giorgio Calzolari, Christian Mücher

| Title | Authors | Year | Actions |

|---|

Comments (0)