Authors

Summary

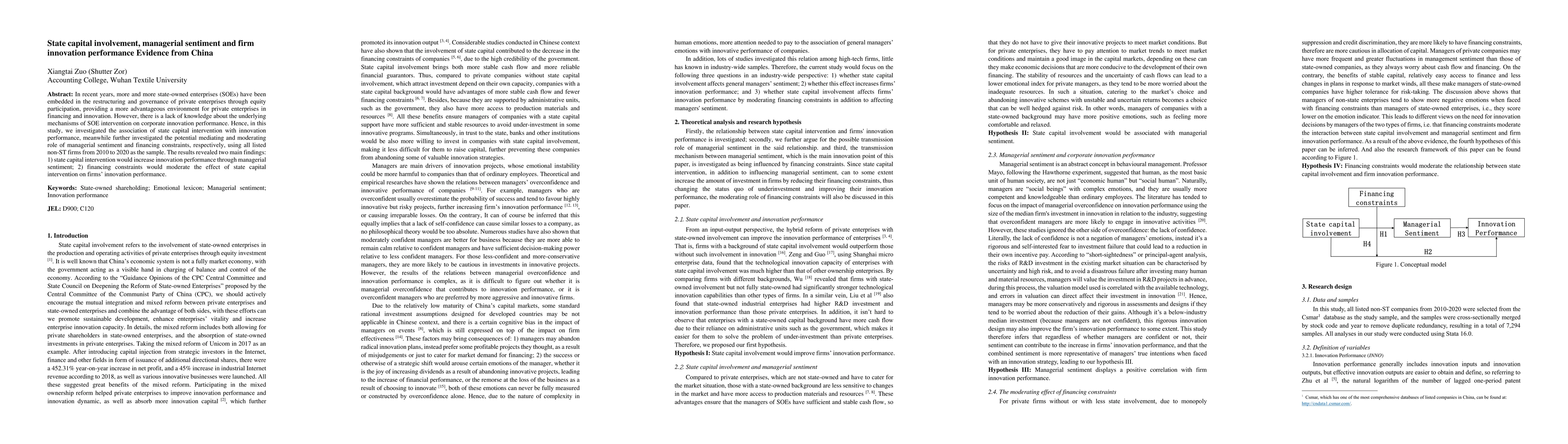

In recent years, more and more state-owned enterprises (SOEs) have been embedded in the restructuring and governance of private enterprises through equity participation, providing a more advantageous environment for private enterprises in financing and innovation. However, there is a lack of knowledge about the underlying mechanisms of SOE intervention on corporate innovation performance. Hence, in this study, we investigated the association of state capital intervention with innovation performance, meanwhile further investigated the potential mediating and moderating role of managerial sentiment and financing constraints, respectively, using all listed non-ST firms from 2010 to 2020 as the sample. The results revealed two main findings: 1) state capital intervention would increase innovation performance through managerial sentiment; 2) financing constraints would moderate the effect of state capital intervention on firms' innovation performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Performance and Innovation: Evidence From USA, 1998-2023

Panteleimon Kruglov, Charles Shaw

No citations found for this paper.

Comments (0)