Summary

Statistical arbitrage methods identify mispricings in securities with the goal of building portfolios which are weakly correlated with the market. In pairs trading, an arbitrage opportunity is identified by observing relative price movements between a pair of two securities. By simultaneously observing multiple pairs, one can exploit different arbitrage opportunities and increase the performance of such methods. However, the use of a large number of pairs is difficult due to the increased probability of contradictory trade signals among different pairs. In this paper, we propose a novel portfolio construction method based on preference relation graphs, which can reconcile contradictory pairs trading signals across multiple security pairs. The proposed approach enables joint exploitation of arbitrage opportunities among a large number of securities. Experimental results using three decades of historical returns of roughly 500 stocks from the S\&P 500 index show that the portfolios based on preference relations exhibit robust returns even with high transaction costs, and that their performance improves with the number of securities considered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

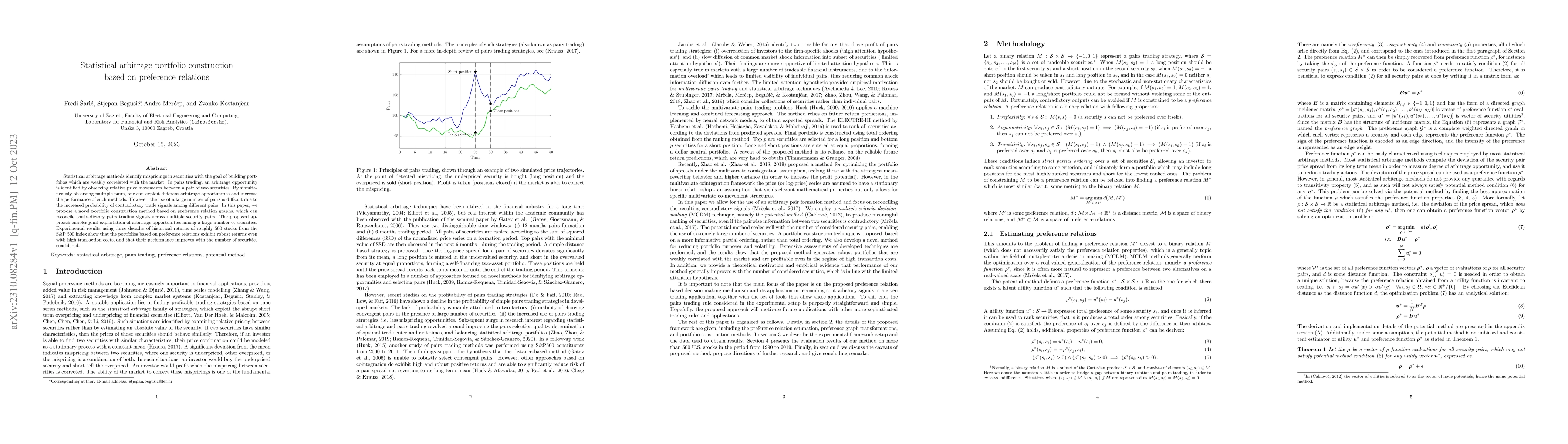

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical Arbitrage for Multiple Co-Integrated Stocks

A. Papanicolaou, T. N. Li

Deep Learning Statistical Arbitrage

Markus Pelger, Greg Zanotti, Jorge Guijarro-Ordonez

| Title | Authors | Year | Actions |

|---|

Comments (0)