Summary

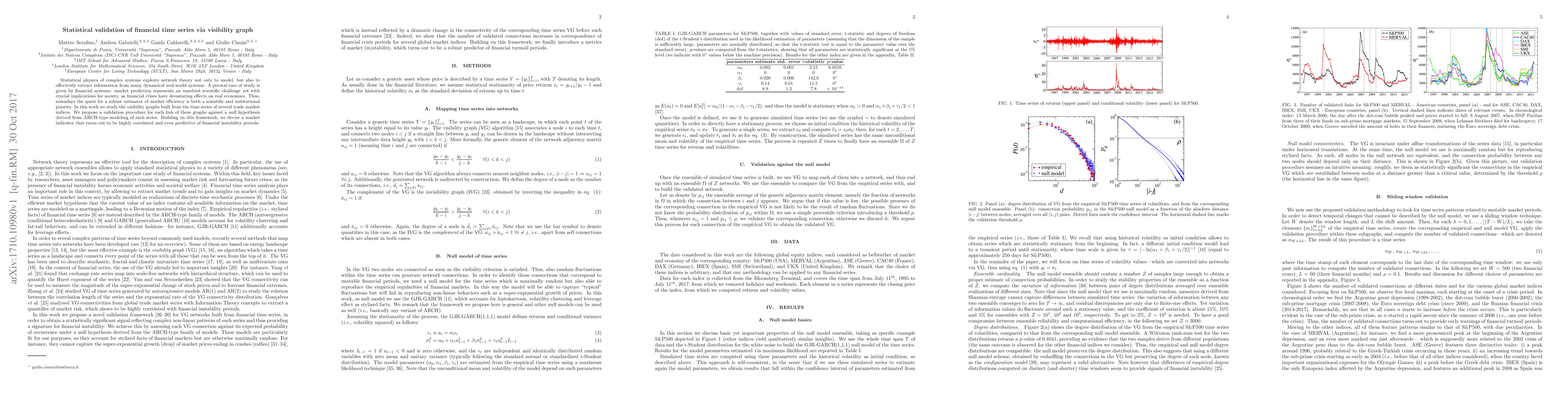

Statistical physics of complex systems exploits network theory not only to model, but also to effectively extract information from many dynamical real-world systems. A pivotal case of study is given by financial systems: market prediction represents an unsolved scientific challenge yet with crucial implications for society, as financial crises have devastating effects on real economies. Thus, nowadays the quest for a robust estimator of market efficiency is both a scientific and institutional priority. In this work we study the visibility graphs built from the time series of several trade market indices. We propose a validation procedure for each link of these graphs against a null hypothesis derived from ARCH-type modeling of such series. Building on this framework, we devise a market indicator that turns out to be highly correlated and even predictive of financial instability periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)