Summary

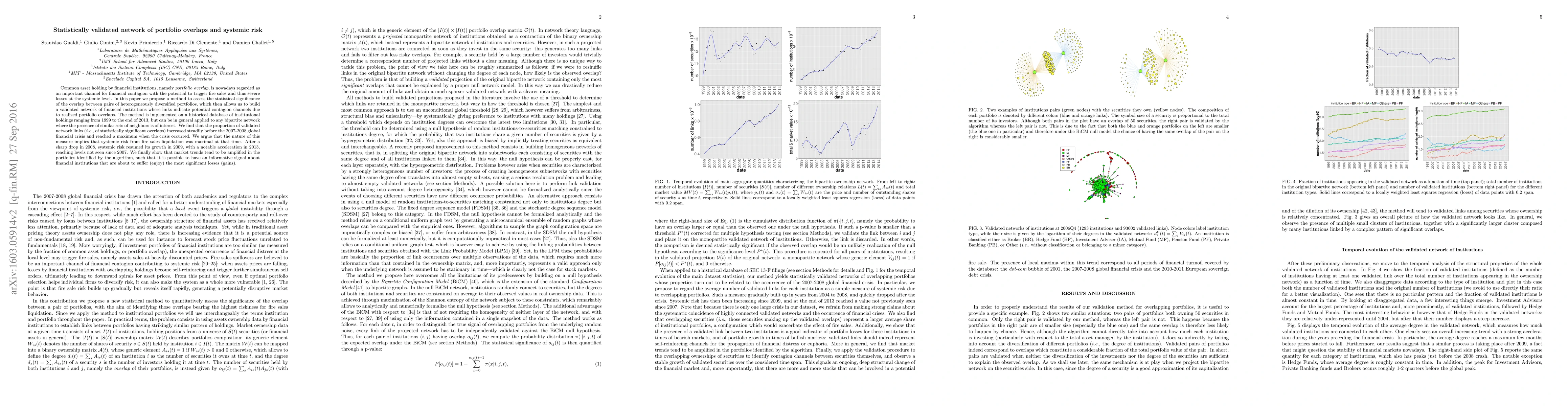

Common asset holding by financial institutions, namely portfolio overlap, is nowadays regarded as an important channel for financial contagion with the potential to trigger fire sales and thus severe losses at the systemic level. In this paper we propose a method to assess the statistical significance of the overlap between pairs of heterogeneously diversified portfolios, which then allows us to build a validated network of financial institutions where links indicate potential contagion channels due to realized portfolio overlaps. The method is implemented on a historical database of institutional holdings ranging from 1999 to the end of 2013, but can be in general applied to any bipartite network where the presence of similar sets of neighbors is of interest. We find that the proportion of validated network links (i.e., of statistically significant overlaps) increased steadily before the 2007-2008 global financial crisis and reached a maximum when the crisis occurred. We argue that the nature of this measure implies that systemic risk from fire sales liquidation was maximal at that time. After a sharp drop in 2008, systemic risk resumed its growth in 2009, with a notable acceleration in 2013, reaching levels not seen since 2007. We finally show that market trends tend to be amplified in the portfolios identified by the algorithm, such that it is possible to have an informative signal about financial institutions that are about to suffer (enjoy) the most significant losses (gains).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)