Authors

Summary

We derive sufficient conditions for the convex and monotonic g-stochastic ordering of diffusion processes under nonlinear g-expectations and g-evaluations. Our approach relies on comparison results for forward-backward stochastic differential equations and on several extensions of convexity, monotonicity and continuous dependence properties for the solutions of associated semilinear parabolic partial differential equations. Applications to contingent claim price comparison under different hedging portfolio constraints are provided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

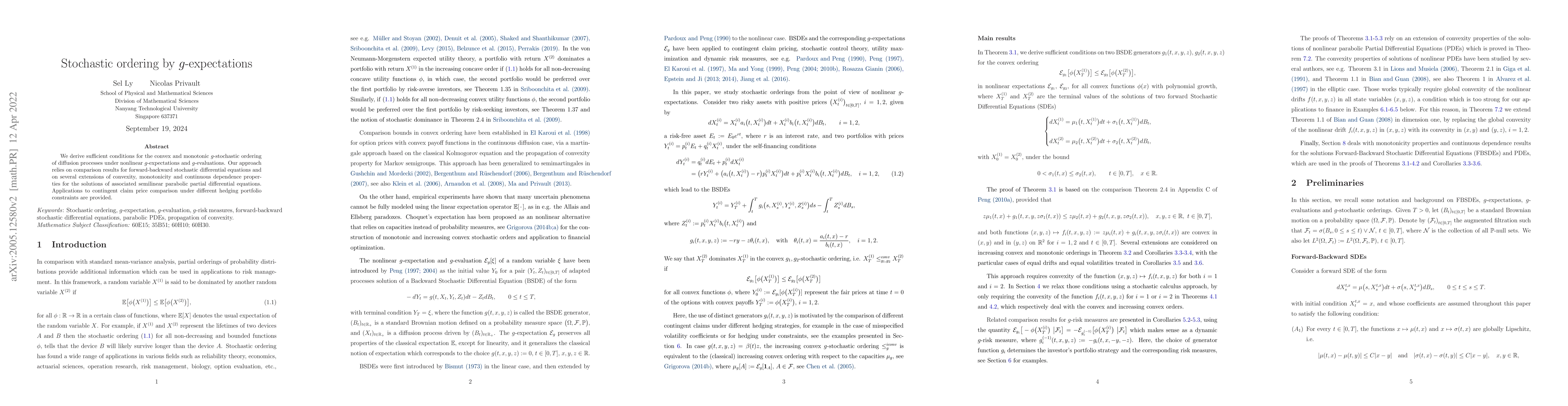

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)