Summary

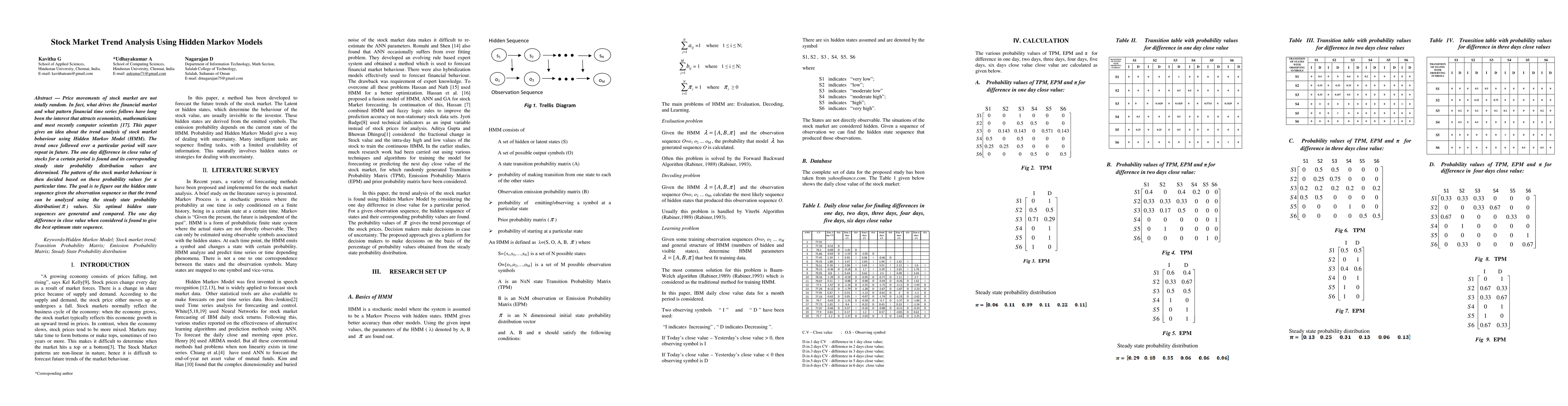

Price movements of stock market are not totally random. In fact, what drives the financial market and what pattern financial time series follows have long been the interest that attracts economists, mathematicians and most recently computer scientists [17]. This paper gives an idea about the trend analysis of stock market behaviour using Hidden Markov Model (HMM). The trend once followed over a particular period will sure repeat in future. The one day difference in close value of stocks for a certain period is found and its corresponding steady state probability distribution values are determined. The pattern of the stock market behaviour is then decided based on these probability values for a particular time. The goal is to figure out the hidden state sequence given the observation sequence so that the trend can be analyzed using the steady state probability distribution( ) values. Six optimal hidden state sequences are generated and compared. The one day difference in close value when considered is found to give the best optimum state sequence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHidden Markov Models for Stock Market Prediction

Luigi Catello, Ludovica Ruggiero, Lucia Schiavone et al.

DSE Stock Price Prediction using Hidden Markov Model

Md. Golam Rabiul Alam, Md Tanvir Rouf Shawon, Raihan Tanvir

| Title | Authors | Year | Actions |

|---|

Comments (0)