Summary

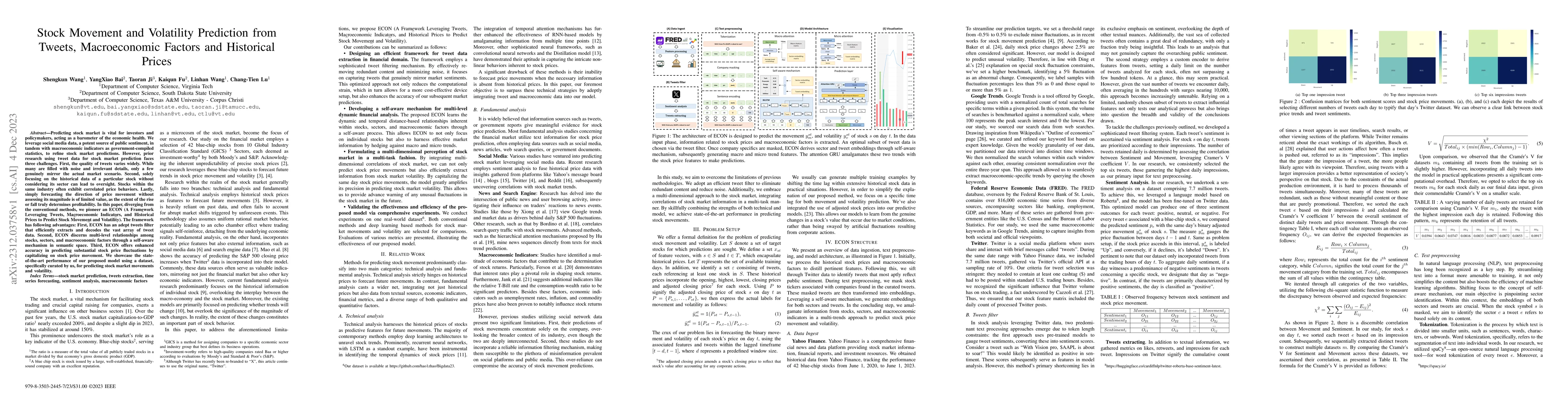

Predicting stock market is vital for investors and policymakers, acting as a barometer of the economic health. We leverage social media data, a potent source of public sentiment, in tandem with macroeconomic indicators as government-compiled statistics, to refine stock market predictions. However, prior research using tweet data for stock market prediction faces three challenges. First, the quality of tweets varies widely. While many are filled with noise and irrelevant details, only a few genuinely mirror the actual market scenario. Second, solely focusing on the historical data of a particular stock without considering its sector can lead to oversight. Stocks within the same industry often exhibit correlated price behaviors. Lastly, simply forecasting the direction of price movement without assessing its magnitude is of limited value, as the extent of the rise or fall truly determines profitability. In this paper, diverging from the conventional methods, we pioneer an ECON. The framework has following advantages: First, ECON has an adept tweets filter that efficiently extracts and decodes the vast array of tweet data. Second, ECON discerns multi-level relationships among stocks, sectors, and macroeconomic factors through a self-aware mechanism in semantic space. Third, ECON offers enhanced accuracy in predicting substantial stock price fluctuations by capitalizing on stock price movement. We showcase the state-of-the-art performance of our proposed model using a dataset, specifically curated by us, for predicting stock market movements and volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersALERTA-Net: A Temporal Distance-Aware Recurrent Networks for Stock Movement and Volatility Prediction

Shengkun Wang, Taoran Ji, Linhan Wang et al.

LLMFactor: Extracting Profitable Factors through Prompts for Explainable Stock Movement Prediction

Hiroki Sakaji, Kiyoshi Izumi, Meiyun Wang

Macroeconomic factors and Stock exchange return: A Statistical Analysis

Md. Fazlul Huq Khan, Md. Masum Billah

Stock prices and Macroeconomic indicators: Investigating a correlation in Indian context

Dhruv Rawat, Sujay Patni, Ram Mehta

| Title | Authors | Year | Actions |

|---|

Comments (0)