Authors

Summary

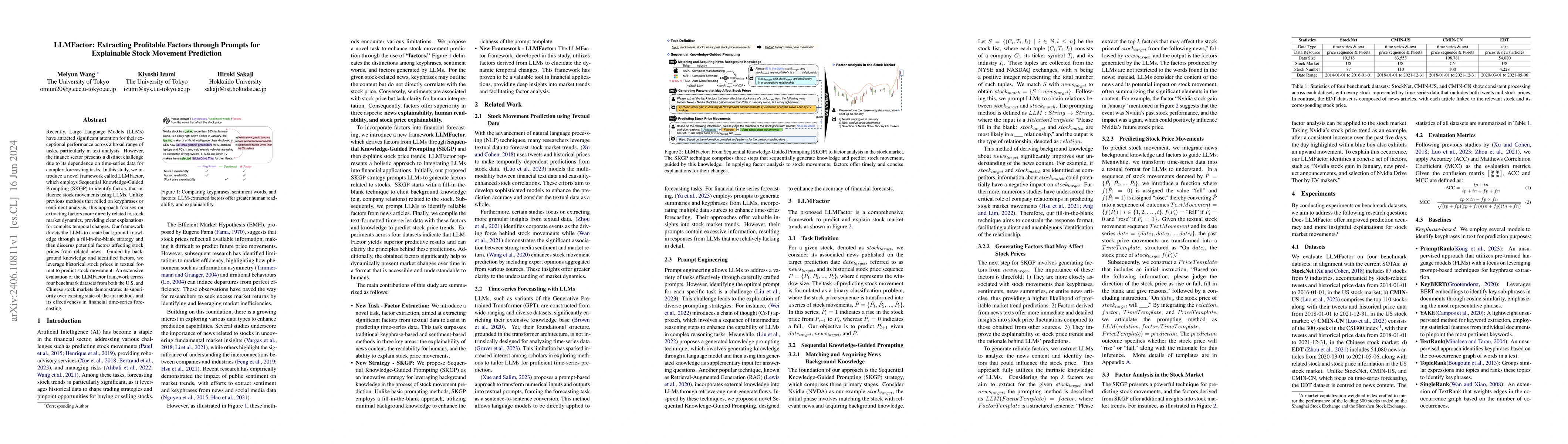

Recently, Large Language Models (LLMs) have attracted significant attention for their exceptional performance across a broad range of tasks, particularly in text analysis. However, the finance sector presents a distinct challenge due to its dependence on time-series data for complex forecasting tasks. In this study, we introduce a novel framework called LLMFactor, which employs Sequential Knowledge-Guided Prompting (SKGP) to identify factors that influence stock movements using LLMs. Unlike previous methods that relied on keyphrases or sentiment analysis, this approach focuses on extracting factors more directly related to stock market dynamics, providing clear explanations for complex temporal changes. Our framework directs the LLMs to create background knowledge through a fill-in-the-blank strategy and then discerns potential factors affecting stock prices from related news. Guided by background knowledge and identified factors, we leverage historical stock prices in textual format to predict stock movement. An extensive evaluation of the LLMFactor framework across four benchmark datasets from both the U.S. and Chinese stock markets demonstrates its superiority over existing state-of-the-art methods and its effectiveness in financial time-series forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpatiotemporal Transformer for Stock Movement Prediction

Jugal Kalita, Daniel Boyle

Stock Movement and Volatility Prediction from Tweets, Macroeconomic Factors and Historical Prices

Shengkun Wang, Taoran Ji, Linhan Wang et al.

CausalStock: Deep End-to-end Causal Discovery for News-driven Stock Movement Prediction

Rui Yan, Xin Gao, Shuo Shang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)