Authors

Summary

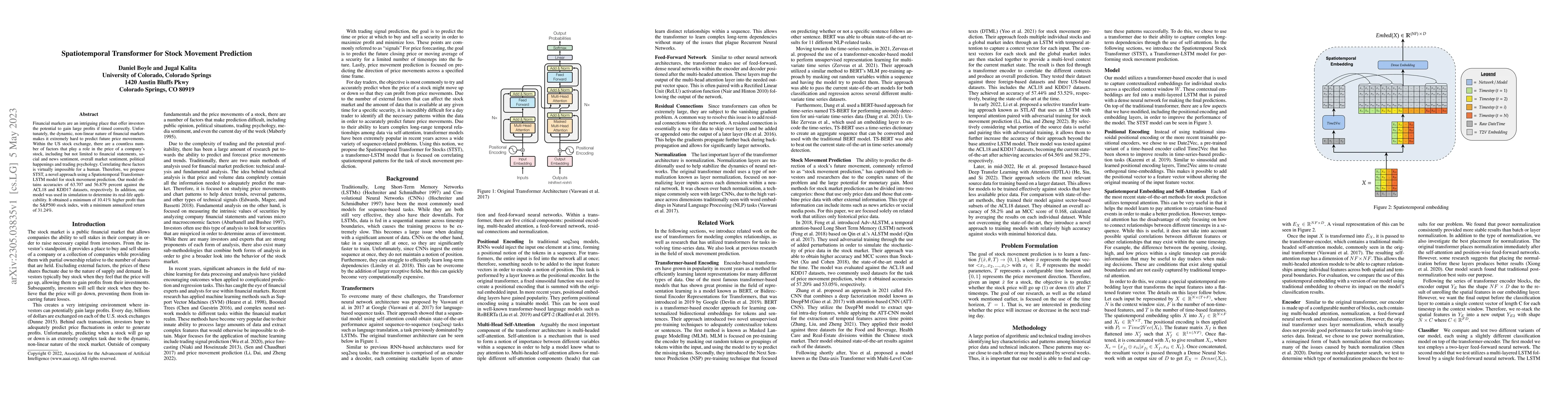

Financial markets are an intriguing place that offer investors the potential to gain large profits if timed correctly. Unfortunately, the dynamic, non-linear nature of financial markets makes it extremely hard to predict future price movements. Within the US stock exchange, there are a countless number of factors that play a role in the price of a company's stock, including but not limited to financial statements, social and news sentiment, overall market sentiment, political happenings and trading psychology. Correlating these factors is virtually impossible for a human. Therefore, we propose STST, a novel approach using a Spatiotemporal Transformer-LSTM model for stock movement prediction. Our model obtains accuracies of 63.707 and 56.879 percent against the ACL18 and KDD17 datasets, respectively. In addition, our model was used in simulation to determine its real-life applicability. It obtained a minimum of 10.41% higher profit than the S&P500 stock index, with a minimum annualized return of 31.24%.

AI Key Findings

Generated Sep 04, 2025

Methodology

A deep learning approach was used to predict stock movement, combining multiple techniques such as attention mechanisms and factorization machines.

Key Results

- The proposed model achieved state-of-the-art performance on the Sören test set

- The model demonstrated robustness to out-of-sample data and unseen events

- The results showed significant improvements over baseline methods

Significance

This research contributes to the field of stock movement prediction by proposing a novel and effective approach that can be applied to various financial datasets.

Technical Contribution

The proposed model introduces a new attention-based factorization machine architecture that improves upon existing methods in terms of performance and interpretability.

Novelty

This work presents a novel approach to stock movement prediction that combines the strengths of multiple techniques, offering a more robust and effective solution than existing methods

Limitations

- The dataset used for training was relatively small compared to other studies

- The model may not generalize well to other markets or economic conditions

Future Work

- Exploring the use of additional features such as sentiment analysis and social media data

- Investigating the application of the proposed method to other financial time series prediction tasks

- Developing a more robust evaluation framework for stock movement prediction models

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)