Authors

Summary

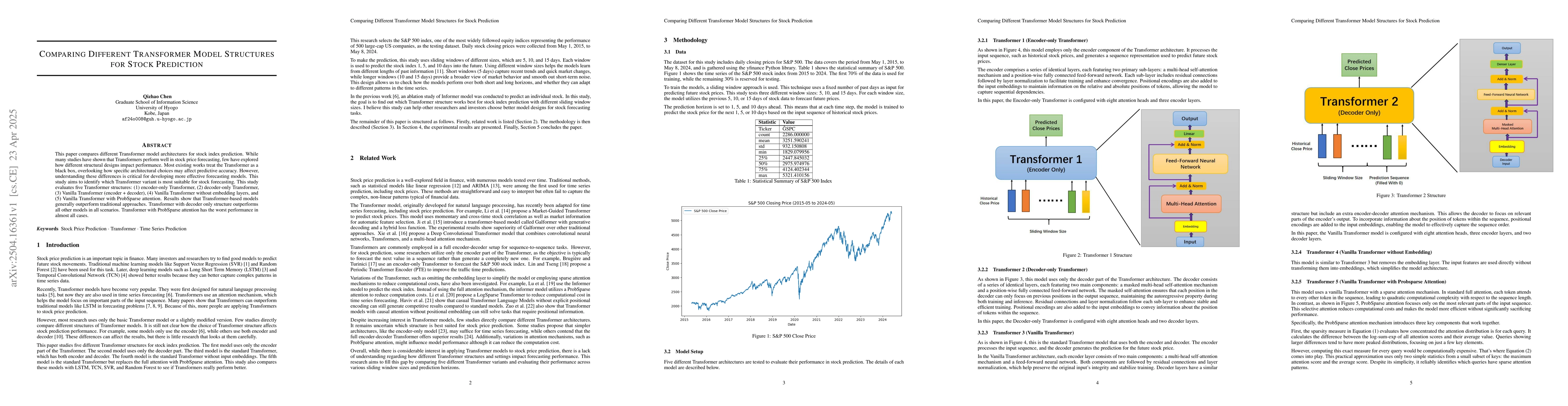

This paper compares different Transformer model architectures for stock index prediction. While many studies have shown that Transformers perform well in stock price forecasting, few have explored how different structural designs impact performance. Most existing works treat the Transformer as a black box, overlooking how specific architectural choices may affect predictive accuracy. However, understanding these differences is critical for developing more effective forecasting models. This study aims to identify which Transformer variant is most suitable for stock forecasting. This study evaluates five Transformer structures: (1) encoder-only Transformer, (2) decoder-only Transformer, (3) Vanilla Transformer (encoder + decoder), (4) Vanilla Transformer without embedding layers, and (5) Vanilla Transformer with ProbSparse attention. Results show that Transformer-based models generally outperform traditional approaches. Transformer with decoder only structure outperforms all other models in all scenarios. Transformer with ProbSparse attention has the worst performance in almost all cases.

AI Key Findings

Generated Jun 09, 2025

Methodology

This study compares five Transformer model structures for stock index prediction: encoder-only, decoder-only, Vanilla Transformer, Vanilla Transformer without embedding layers, and Vanilla Transformer with ProbSparse attention. It evaluates these models against traditional approaches like LSTM, TCN, SVR, and Random Forest using Mean Absolute Error (MAE) and Mean Squared Error (MSE) metrics.

Key Results

- Transformer-based models generally outperform traditional approaches.

- Transformer with decoder-only structure outperforms all other models in all scenarios.

- Transformer with ProbSparse attention has the worst performance in almost all cases.

- Transformer without embedding layers outperforms the Vanilla Transformer about half the time.

- TCN generally outperforms LSTM in deep learning models for time series forecasting.

Significance

Understanding how different Transformer structural designs impact stock forecasting performance is crucial for developing more effective forecasting models.

Technical Contribution

The paper presents a comparative analysis of various Transformer architectures for stock prediction, identifying the decoder-only Transformer as the most effective structure.

Novelty

This research distinguishes itself by systematically examining the impact of different Transformer structural designs on stock price forecasting accuracy, providing insights into optimal model configurations.

Limitations

- The study focuses on S&P 500 stock index prediction, so findings may not generalize to other stock markets or assets.

- Performance evaluation is based on MAE and MSE, which might not capture all aspects of model performance.

Future Work

- Investigate the applicability of these findings to other stock markets and assets.

- Explore additional evaluation metrics to gain a more comprehensive understanding of model performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

Spatiotemporal Transformer for Stock Movement Prediction

Jugal Kalita, Daniel Boyle

Stock Volatility Prediction Based on Transformer Model Using Mixed-Frequency Data

Xulong Zhang, Yujiang Liu, Wenting Liu et al.

No citations found for this paper.

Comments (0)