Summary

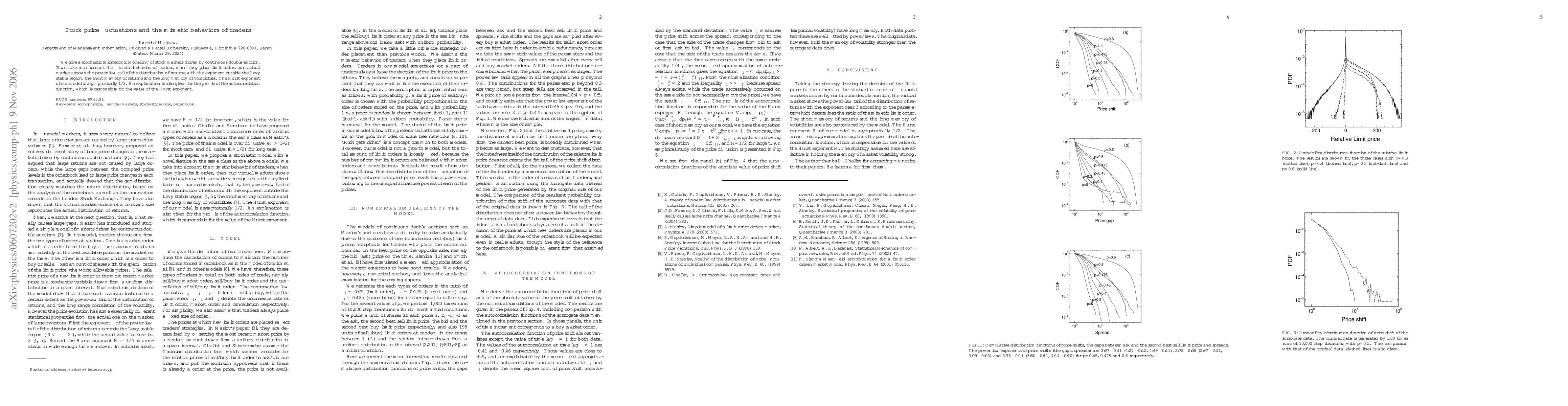

We give a stochastic microscopic modelling of stock markets driven by continuous double auction. If we take into account the mimetic behavior of traders, when they place limit order, our virtual markets shows the power-law tail of the distribution of returns with the exponent outside the Levy stable region, the short memory of returns and the long memory of volatilities. The Hurst exponent of our model is asymptotically 1/2. An explanation is also given for the profile of the autocorrelation function, which is responsible for the value of the Hurst exponent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)