Summary

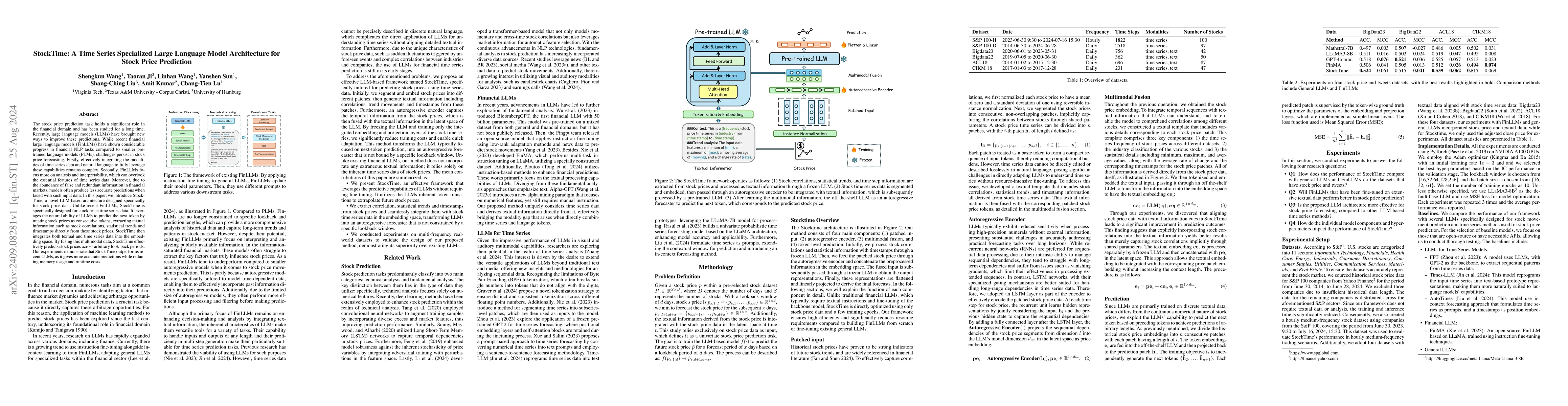

The stock price prediction task holds a significant role in the financial domain and has been studied for a long time. Recently, large language models (LLMs) have brought new ways to improve these predictions. While recent financial large language models (FinLLMs) have shown considerable progress in financial NLP tasks compared to smaller pre-trained language models (PLMs), challenges persist in stock price forecasting. Firstly, effectively integrating the modalities of time series data and natural language to fully leverage these capabilities remains complex. Secondly, FinLLMs focus more on analysis and interpretability, which can overlook the essential features of time series data. Moreover, due to the abundance of false and redundant information in financial markets, models often produce less accurate predictions when faced with such input data. In this paper, we introduce StockTime, a novel LLM-based architecture designed specifically for stock price data. Unlike recent FinLLMs, StockTime is specifically designed for stock price time series data. It leverages the natural ability of LLMs to predict the next token by treating stock prices as consecutive tokens, extracting textual information such as stock correlations, statistical trends and timestamps directly from these stock prices. StockTime then integrates both textual and time series data into the embedding space. By fusing this multimodal data, StockTime effectively predicts stock prices across arbitrary look-back periods. Our experiments demonstrate that StockTime outperforms recent LLMs, as it gives more accurate predictions while reducing memory usage and runtime costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

Natural Language Processing and Multimodal Stock Price Prediction

Kevin Taylor, Jerry Ng

Stock Price Prediction Using Time Series, Econometric, Machine Learning, and Deep Learning Models

Jaydip Sen, Ananda Chatterjee, Hrisav Bhowmick

| Title | Authors | Year | Actions |

|---|

Comments (0)