Summary

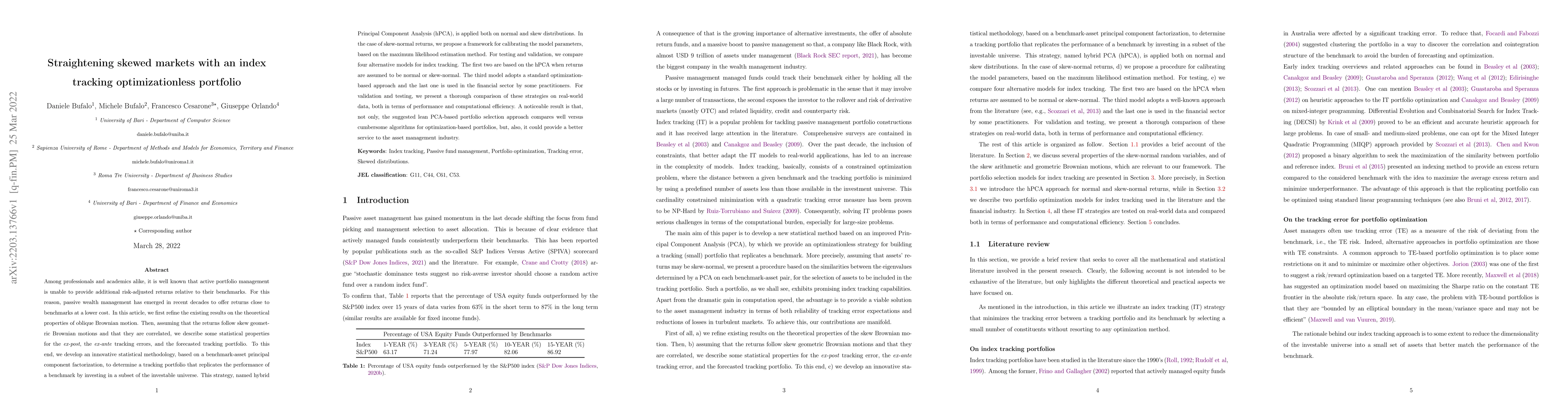

Among professionals and academics alike, it is well known that active portfolio management is unable to provide additional risk-adjusted returns relative to their benchmarks. For this reason, passive wealth management has emerged in recent decades to offer returns close to benchmarks at a lower cost. In this article, we first refine the existing results on the theoretical properties of oblique Brownian motion. Then, assuming that the returns follow skew geometric Brownian motions and that they are correlated, we describe some statistical properties for the \emph{ex-post}, the \emph{ex-ante} tracking errors, and the forecasted tracking portfolio. To this end, we develop an innovative statistical methodology, based on a benchmark-asset principal component factorization, to determine a tracking portfolio that replicates the performance of a benchmark by investing in a subset of the investable universe. This strategy, named hybrid Principal Component Analysis (hPCA), is applied both on normal and skew distributions. In the case of skew-normal returns, we propose a framework for calibrating the model parameters, based on the maximum likelihood estimation method. For testing and validation, we compare four alternative models for index tracking. The first two are based on the hPCA when returns are assumed to be normal or skew-normal. The third model adopts a standard optimization-based approach and the last one is used in the financial sector by some practitioners. For validation and testing, we present a thorough comparison of these strategies on real-world data, both in terms of performance and computational efficiency. A noticeable result is that, not only, the suggested lean PCA-based portfolio selection approach compares well versus cumbersome algorithms for optimization-based portfolios, but, also, it could provide a better service to the asset management industry.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsset pre-selection for a cardinality constrained index tracking portfolio with optional enhancement

J. E. Beasley, N. Meade, C. A. Valle

Sparse Index Tracking: Simultaneous Asset Selection and Capital Allocation via $\ell_0$-Constrained Portfolio

Shunsuke Ono, Eisuke Yamagata

| Title | Authors | Year | Actions |

|---|

Comments (0)