Summary

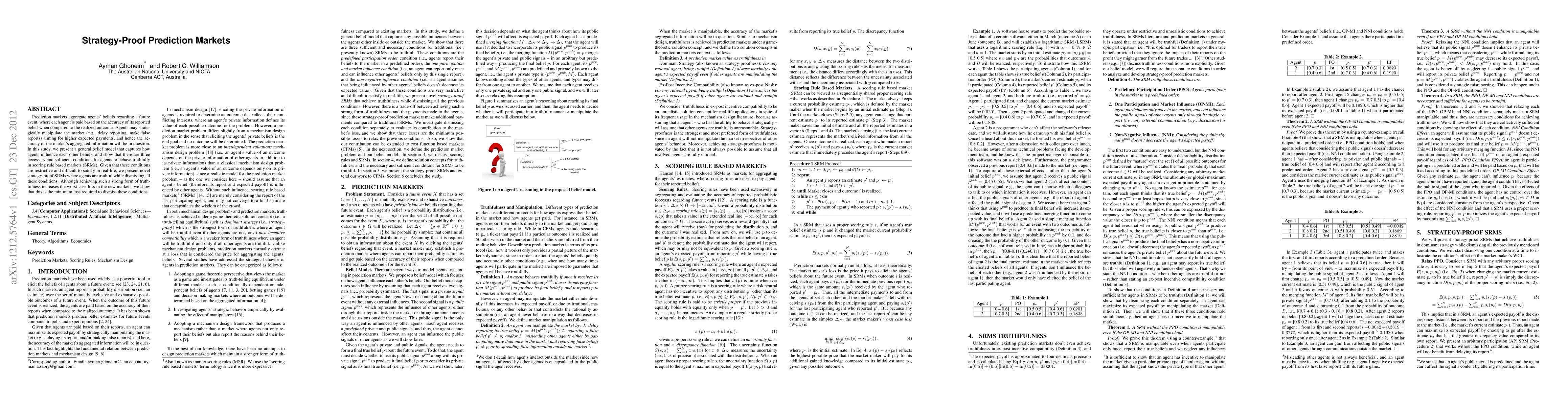

Prediction markets aggregate agents' beliefs regarding a future event, where each agent is paid based on the accuracy of its reported belief when compared to the realized outcome. Agents may strategically manipulate the market (e.g., delay reporting, make false reports) aiming for higher expected payments, and hence the accuracy of the market's aggregated information will be in question. In this study, we present a general belief model that captures how agents influence each other beliefs, and show that there are three necessary and sufficient conditions for agents to behave truthfully in scoring rule based markets (SRMs). Given that these conditions are restrictive and difficult to satisfy in real-life, we present novel strategy-proof SRMs where agents are truthful while dismissing all these conditions. Although achieving such a strong form of truthfulness increases the worst-case loss in the new markets, we show that this is the minimum loss required to dismiss these conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategy-Proof Auctions through Conformal Prediction

Inbal Talgam-Cohen, Yaniv Romano, Roy Maor Lotan

A Strategy-proof Mechanism For Networked Housing Markets

Youjia Zhang, Pingzhong Tang

No citations found for this paper.

Comments (0)