Summary

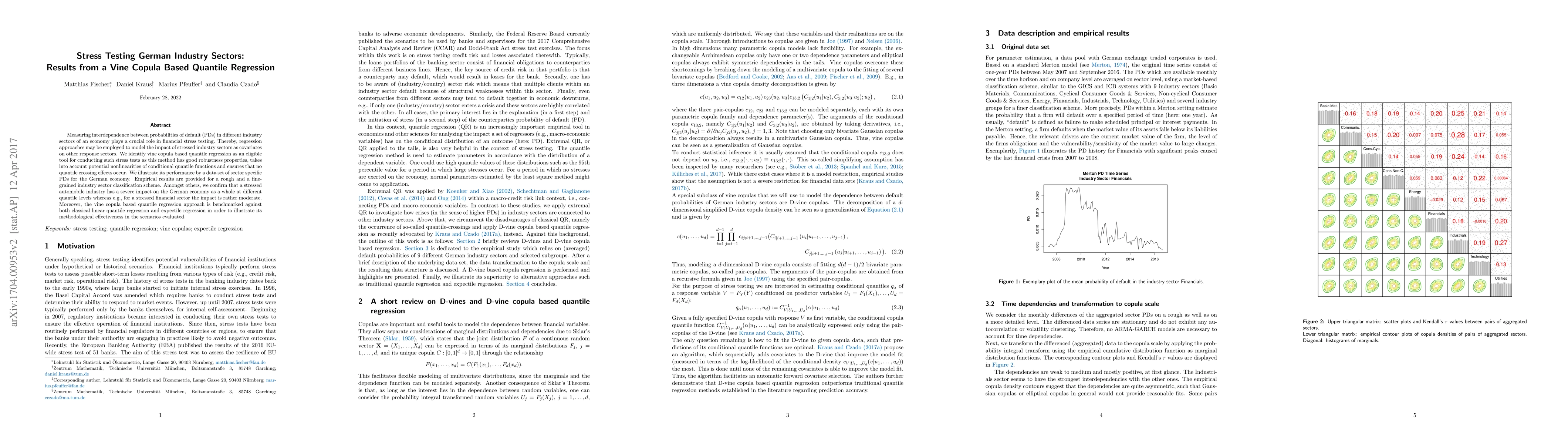

Measuring interdependence between probabilities of default (PDs) in different industry sectors of an economy plays a crucial role in financial stress testing. Thereby, regression approaches may be employed to model the impact of stressed industry sectors as covariates on other response sectors. We identify vine copula based quantile regression as an eligible tool for conducting such stress tests as this method has good robustness properties, takes into account potential nonlinearities of conditional quantile functions and ensures that no quantile crossing effects occur. We illustrate its performance by a data set of sector specific PDs for the German economy. Empirical results are provided for a rough and a fine-grained industry sector classification scheme. Amongst others, we confirm that a stressed automobile industry has a severe impact on the German economy as a whole at different quantile levels whereas e.g., for a stressed financial sector the impact is rather moderate. Moreover, the vine copula based quantile regression approach is benchmarked against both classical linear quantile regression and expectile regression in order to illustrate its methodological effectiveness in the scenarios evaluated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBivariate vine copula based regression, bivariate level and quantile curves

Claudia Czado, Marija Tepegjozova

D-Vine GAM Copula based Quantile Regression with Application to Ensemble Postprocessing

David Jobst, Annette Möller, Jürgen Groß

High-dimensional sparse vine copula regression with application to genomic prediction

Özge Sahin, Claudia Czado

| Title | Authors | Year | Actions |

|---|

Comments (0)