Authors

Summary

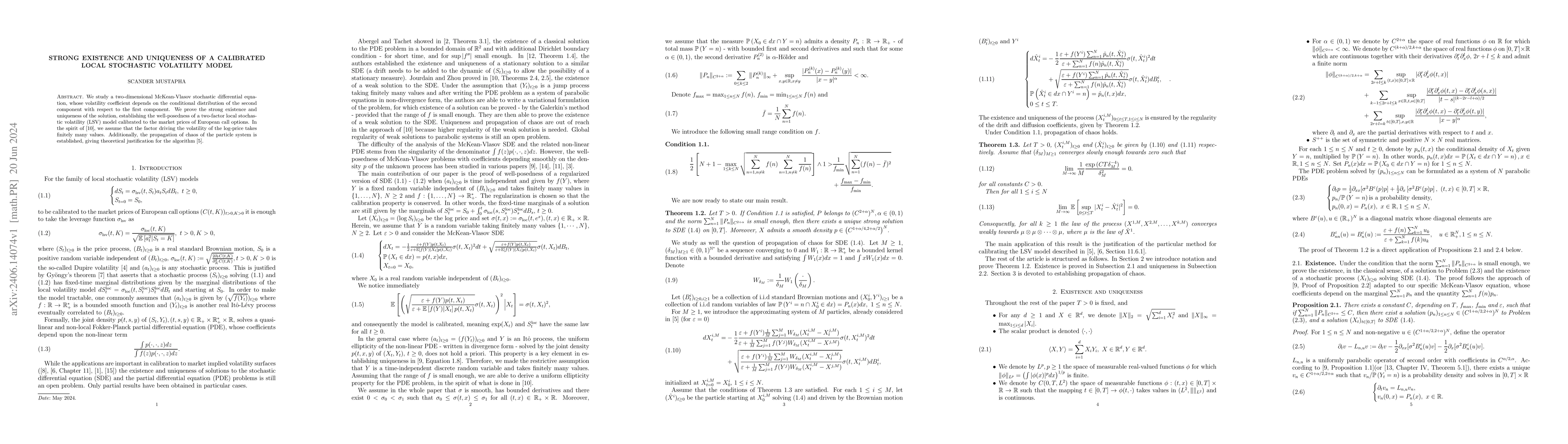

We study a two-dimensional McKean-Vlasov stochastic differential equation, whose volatility coefficient depends on the conditional distribution of the second component with respect to the first component. We prove the strong existence and uniqueness of the solution, establishing the well-posedness of a two-factor local stochastic volatility (LSV) model calibrated to the market prices of European call options. In the spirit of [Jourdain and Zhou, 2020, Existence of a calibrated regime switching local volatility model.], we assume that the factor driving the volatility of the log-price takes finitely many values. Additionally, the propagation of chaos of the particle system is established, giving theoretical justification for the algorithm [Julien Guyon and Henry-Labord\`ere, 2012, Being particular about calibration.].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNumerical analysis of a particle system for the calibrated Heston-type local stochastic volatility model

Christoph Reisinger, Maria Olympia Tsianni

Calibration of the Bass Local Volatility model

Gudmund Pammer, Beatrice Acciaio, Antonio Marini

Existence, uniqueness and positivity of solutions to the Guyon-Lekeufack path-dependent volatility model with general kernels

Hervé Andrès, Benjamin Jourdain

No citations found for this paper.

Comments (0)