Summary

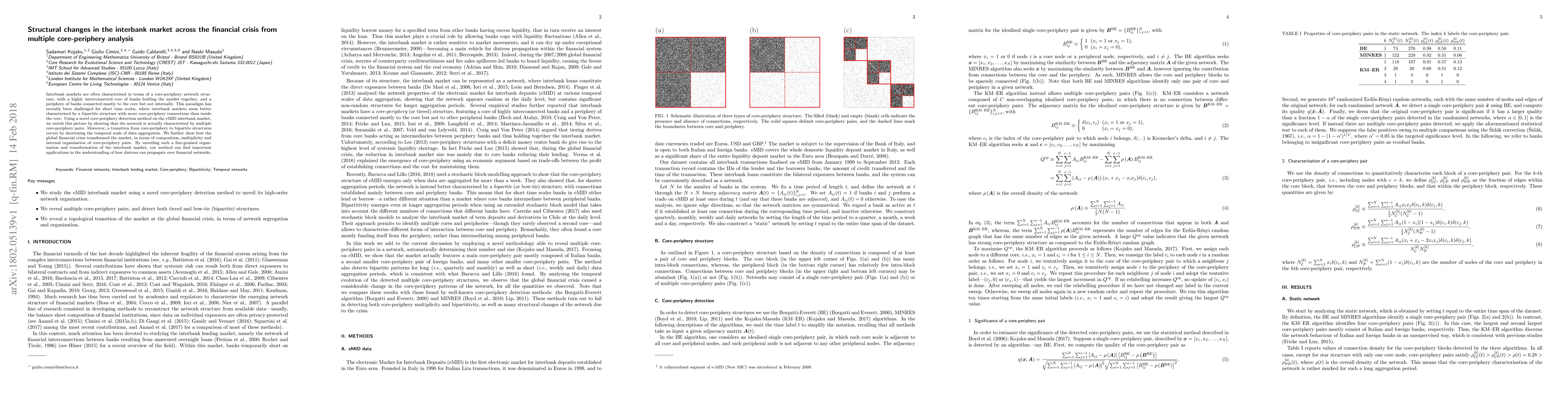

Interbank markets are often characterised in terms of a core-periphery network structure, with a highly interconnected core of banks holding the market together, and a periphery of banks connected mostly to the core but not internally. This paradigm has recently been challenged for short time scales, where interbank markets seem better characterised by a bipartite structure with more core-periphery connections than inside the core. Using a novel core-periphery detection method on the eMID interbank market, we enrich this picture by showing that the network is actually characterised by multiple core-periphery pairs. Moreover, a transition from core-periphery to bipartite structures occurs by shortening the temporal scale of data aggregation. We further show how the global financial crisis transformed the market, in terms of composition, multiplicity and internal organisation of core-periphery pairs. By unveiling such a fine-grained organisation and transformation of the interbank market, our method can find important applications in the understanding of how distress can propagate over financial networks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)