Summary

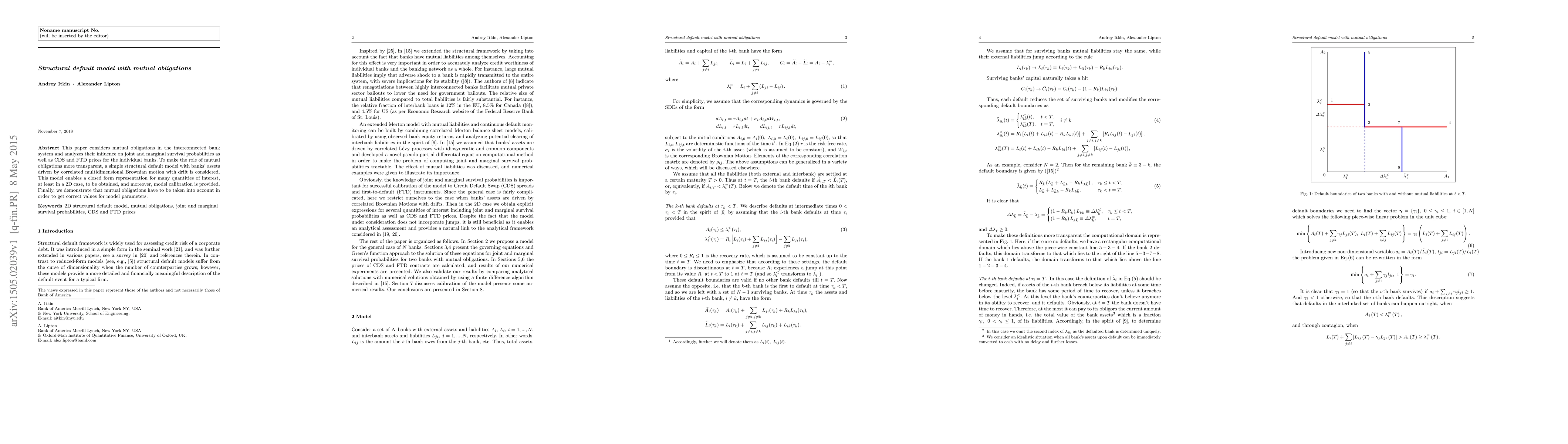

This paper considers mutual obligations in the interconnected bank system and analyzes their influence on joint and marginal survival probabilities as well as CDS and FTD prices for the individual banks. To make the role of mutual obligations more transparent, a simple structural default model with banks' assets driven by correlated multidimensional Brownian motion with drift is considered. This model enables a closed form representation for many quantities of interest, at least in a 2D case, to be obtained, and moreover, model calibration is provided. Finally, we demonstrate that mutual obligations have to be taken into account in order to get correct values for model parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)