Authors

Summary

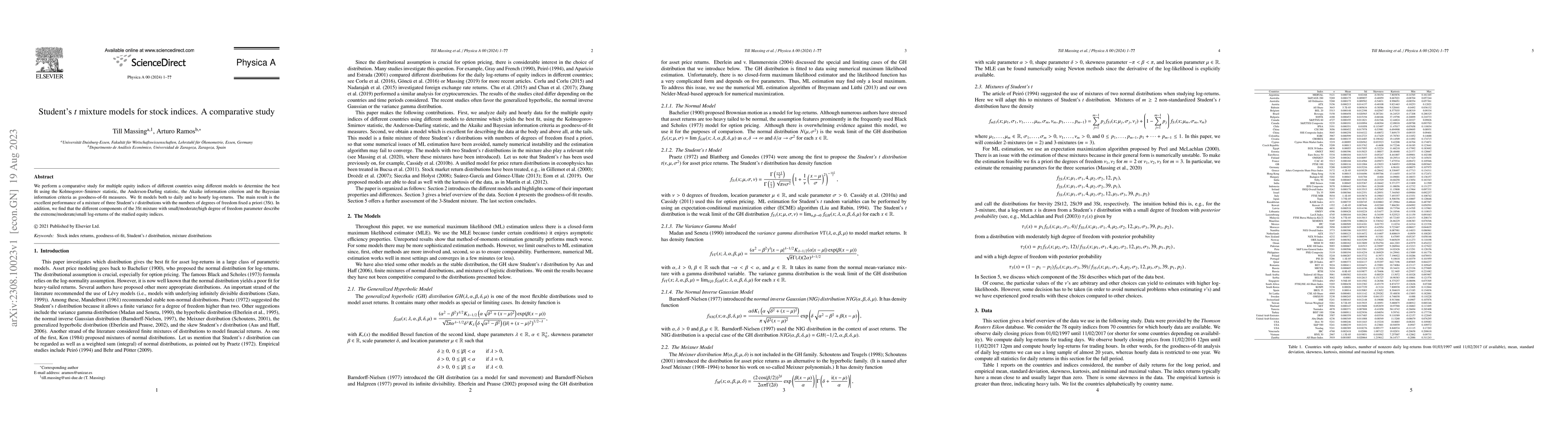

We perform a comparative study for multiple equity indices of different countries using different models to determine the best fit using the Kolmogorov-Smirnov statistic, the Anderson-Darling statistic, the Akaike information criterion and the Bayesian information criteria as goodness-of-fit measures. We fit models both to daily and to hourly log-returns. The main result is the excellent performance of a mixture of three Student's $t$ distributions with the numbers of degrees of freedom fixed a priori (3St). In addition, we find that the different components of the 3St mixture with small/moderate/high degree of freedom parameter describe the extreme/moderate/small log-returns of the studied equity indices.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research performs a comparative study using Student's t-mixture models for multiple equity indices, employing KS, AD, AIC, and BIC as goodness-of-fit measures for daily and hourly log-returns.

Key Results

- A three-component Student's t-distribution (3St) with fixed degrees of freedom outperforms other models in fitting stock index returns.

- The 3St model effectively captures extreme, moderate, and small log-returns, with different components corresponding to these return types.

- For hourly returns, the 3St model also provides an excellent fit, though simpler Student's t-distribution can be used if model complexity is a concern.

Significance

This study contributes to the understanding of stock index return distributions, offering a robust model for both daily and high-frequency data, which can be valuable for risk management and financial modeling.

Technical Contribution

The paper introduces a comparative analysis of Student's t-mixture models for stock index returns, demonstrating the superiority of a three-component model with fixed degrees of freedom.

Novelty

The research distinguishes itself by emphasizing the excellent performance of a 3St model for both daily and hourly log-returns, offering insights into the distribution of stock index returns across different return magnitudes.

Limitations

- The study focuses on a specific set of equity indices, so findings may not generalize to all markets or asset classes.

- The fixed degrees of freedom in the 3St model might limit adaptability to varying market conditions.

Future Work

- Investigate the model's performance with additional equity indices and asset classes.

- Explore dynamic degrees of freedom in the 3St model to enhance adaptability to diverse market conditions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)