Authors

Summary

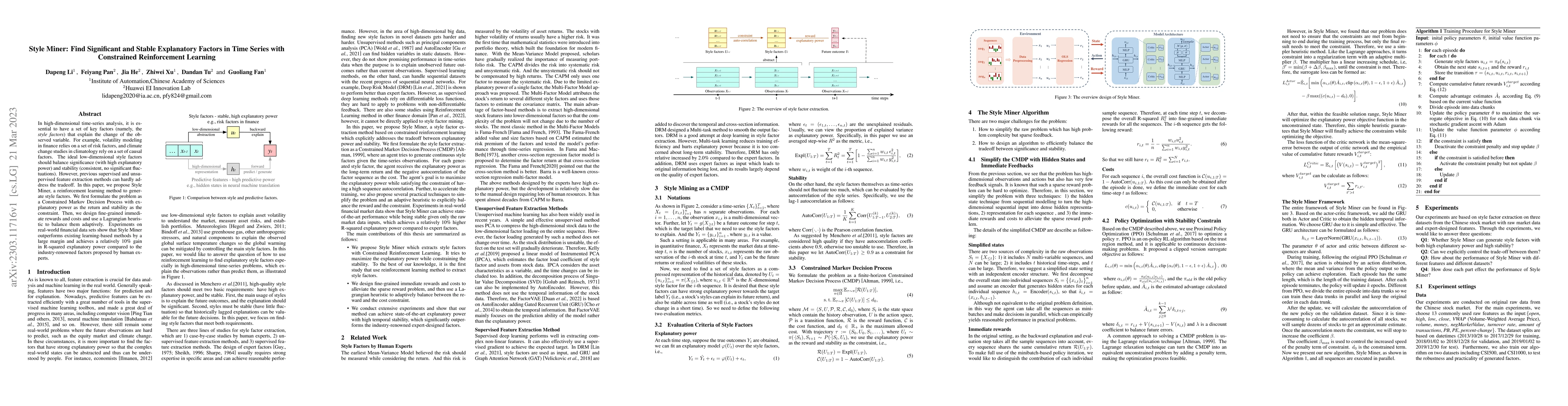

In high-dimensional time-series analysis, it is essential to have a set of key factors (namely, the style factors) that explain the change of the observed variable. For example, volatility modeling in finance relies on a set of risk factors, and climate change studies in climatology rely on a set of causal factors. The ideal low-dimensional style factors should balance significance (with high explanatory power) and stability (consistent, no significant fluctuations). However, previous supervised and unsupervised feature extraction methods can hardly address the tradeoff. In this paper, we propose Style Miner, a reinforcement learning method to generate style factors. We first formulate the problem as a Constrained Markov Decision Process with explanatory power as the return and stability as the constraint. Then, we design fine-grained immediate rewards and costs and use a Lagrangian heuristic to balance them adaptively. Experiments on real-world financial data sets show that Style Miner outperforms existing learning-based methods by a large margin and achieves a relatively 10% gain in R-squared explanatory power compared to the industry-renowned factors proposed by human experts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOPR-Miner: Order-preserving rule mining for time series

Yan Li, Lei Guo, Xindong Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)