Summary

This paper presents a comprehensive statistical analysis of the Web3 ecosystem, comparing various Web3 tokens with traditional financial assets across multiple time scales. We examine probability distributions, tail behaviors, and other key stylized facts of the returns for a diverse range of tokens, including decentralized exchanges, liquidity pools, and centralized exchanges. Despite functional differences, most tokens exhibit well-established empirical facts, including unconditional probability density of returns with heavy tails gradually becoming Gaussian and volatility clustering. Furthermore, we compare assets traded on centralized (CEX) and decentralized (DEX) exchanges, finding that DEXs exhibit similar stylized facts despite different trading mechanisms and often divergent long-term performance. We propose that this similarity is attributable to arbitrageurs striving to maintain similar centralized and decentralized prices. Our study contributes to a better understanding of the dynamics of Web3 tokens and the relationship between CEX and DEX markets, with important implications for risk management, pricing models, and portfolio construction in the rapidly evolving DeFi landscape. These results add to the growing body of literature on cryptocurrency markets and provide insights that can guide the development of more accurate models for DeFi markets.

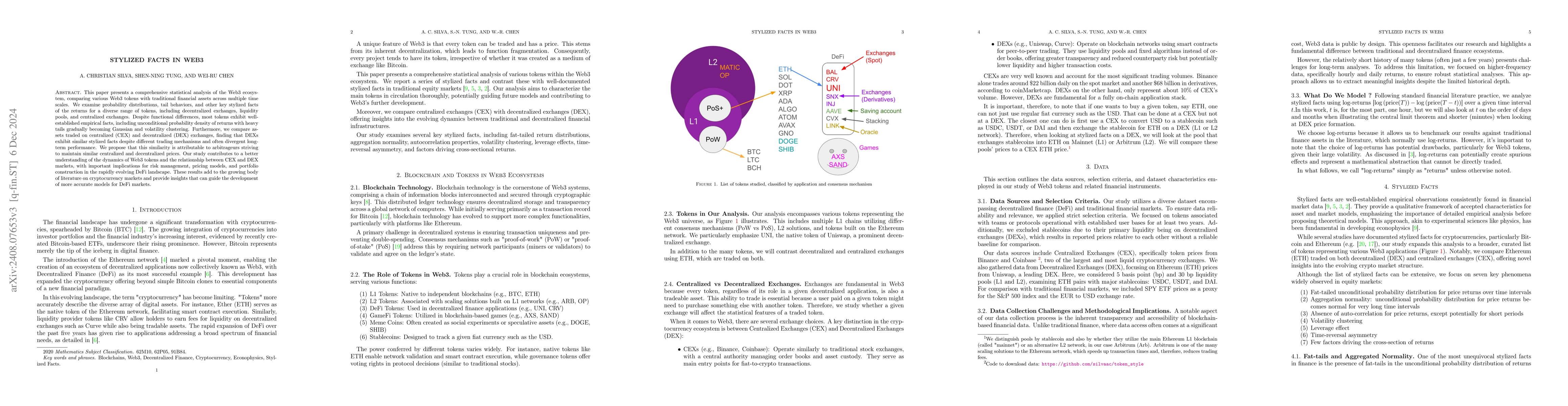

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRevisiting Cont's Stylized Facts for Modern Stock Markets

Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow et al.

No citations found for this paper.

Comments (0)