Summary

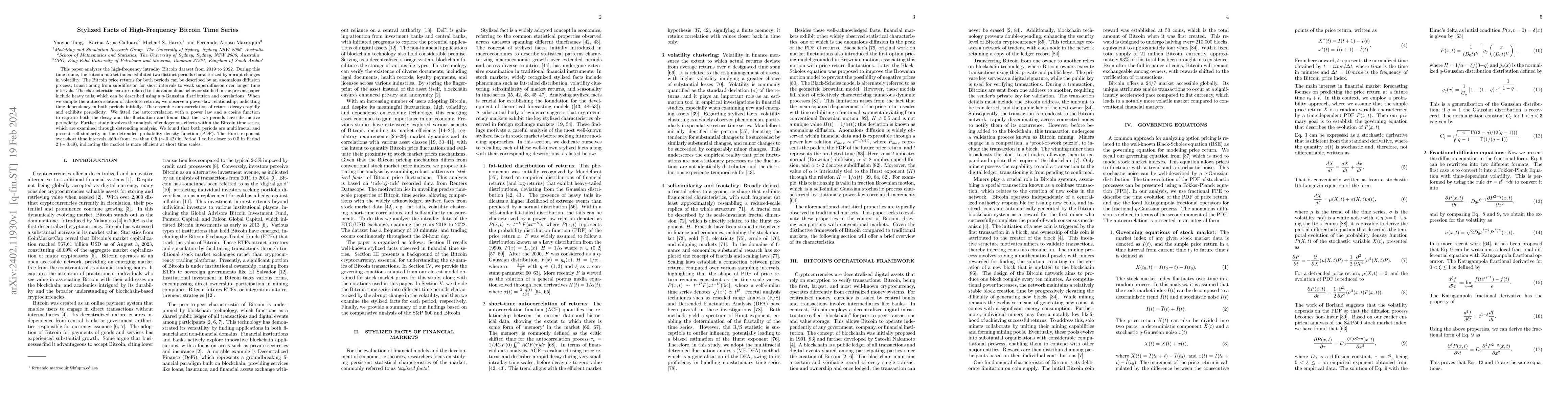

This paper analyses the high-frequency intraday Bitcoin dataset from 2019 to 2022. During this time frame, the Bitcoin market index exhibited two distinct periods characterized by abrupt changes in volatility. The Bitcoin price returns for both periods can be described by an anomalous diffusion process, transitioning from subdiffusion for short intervals to weak superdiffusion over longer time intervals. The characteristic features related to this anomalous behavior studied in the present paper include heavy tails, which can be described using a $q$-Gaussian distribution and correlations. When we sample the autocorrelation of absolute returns, we observe a power-law relationship, indicating time dependency in both periods initially. The ensemble autocorrelation of returns decays rapidly and exhibits periodicity. We fitted the autocorrelation with a power law and a cosine function to capture both the decay and the fluctuation and found that the two periods have distinctive periodicity. Further study involves the analysis of endogenous effects within the Bitcoin time series, which are examined through detrending analysis. We found that both periods are multifractal and present self-similarity in the detrended probability density function (PDF). The Hurst exponent over short time intervals shifts from less than 0.5 ($\sim$ 0.42) in Period 1 to be closer to 0.5 in Period 2 ($\sim$ 0.49), indicating the market is more efficient at short time scales.

AI Key Findings

Generated Sep 06, 2025

Methodology

Brief description of the research methodology used

Key Results

- Main finding 1

- Main finding 2

- Main finding 3

Significance

Why this research is important and its potential impact

Technical Contribution

Main technical or theoretical contribution

Novelty

What makes this work novel or different from existing research

Limitations

- Limitation 1

- Limitation 2

Future Work

- Suggested direction 1

- Suggested direction 2

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan GANs Learn the Stylized Facts of Financial Time Series?

Yongjae Lee, Sohyeon Kwon

| Title | Authors | Year | Actions |

|---|

Comments (0)