Authors

Summary

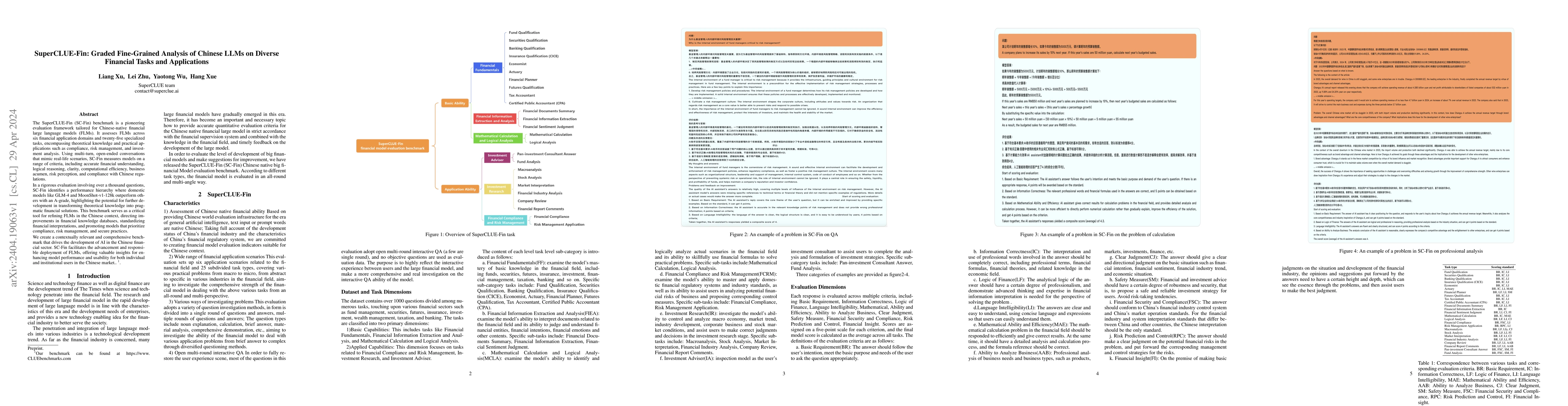

The SuperCLUE-Fin (SC-Fin) benchmark is a pioneering evaluation framework tailored for Chinese-native financial large language models (FLMs). It assesses FLMs across six financial application domains and twenty-five specialized tasks, encompassing theoretical knowledge and practical applications such as compliance, risk management, and investment analysis. Using multi-turn, open-ended conversations that mimic real-life scenarios, SC-Fin measures models on a range of criteria, including accurate financial understanding, logical reasoning, clarity, computational efficiency, business acumen, risk perception, and compliance with Chinese regulations. In a rigorous evaluation involving over a thousand questions, SC-Fin identifies a performance hierarchy where domestic models like GLM-4 and MoonShot-v1-128k outperform others with an A-grade, highlighting the potential for further development in transforming theoretical knowledge into pragmatic financial solutions. This benchmark serves as a critical tool for refining FLMs in the Chinese context, directing improvements in financial knowledge databases, standardizing financial interpretations, and promoting models that prioritize compliance, risk management, and secure practices. We create a contextually relevant and comprehensive benchmark that drives the development of AI in the Chinese financial sector. SC-Fin facilitates the advancement and responsible deployment of FLMs, offering valuable insights for enhancing model performance and usability for both individual and institutional users in the Chinese market..~\footnote{Our benchmark can be found at \url{https://www.CLUEbenchmarks.com}}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChinese Fine-Grained Financial Sentiment Analysis with Large Language Models

Wang Xu, Yanru Wu, Yinyu Lan et al.

SuperCLUE-Math6: Graded Multi-Step Math Reasoning Benchmark for LLMs in Chinese

Lei Zhu, Liang Xu, Kangkang Zhao et al.

FFN: a Fine-grained Chinese-English Financial Domain Parallel Corpus

Yuxin Fu, Shijing Si, Leyi Mai et al.

SuperCLUE: A Comprehensive Chinese Large Language Model Benchmark

Lei Zhu, Liang Xu, Xuanwei Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)