Summary

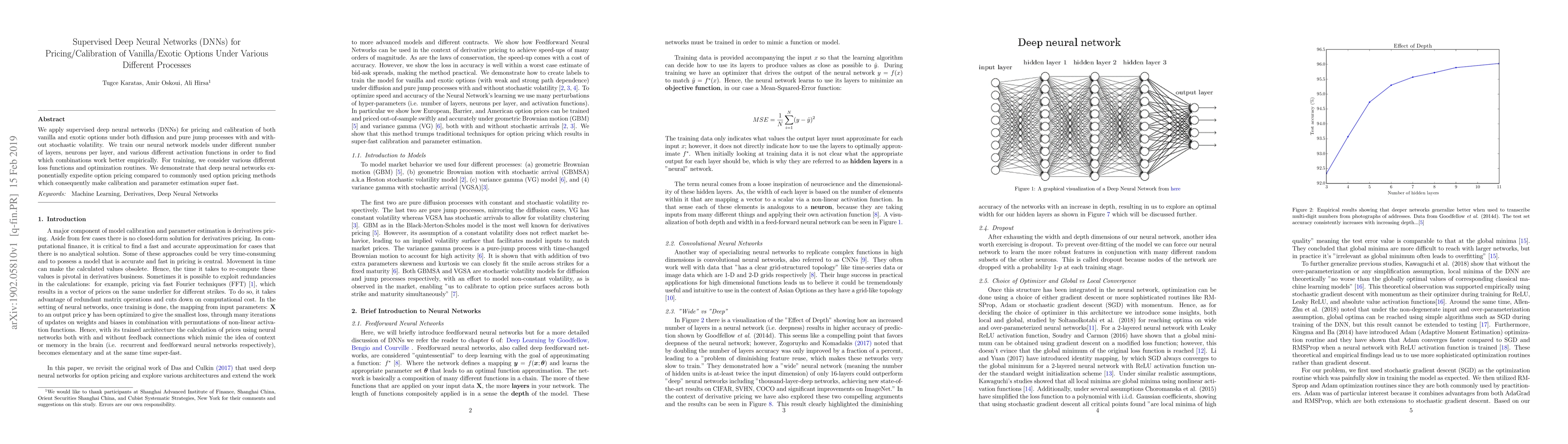

We apply supervised deep neural networks (DNNs) for pricing and calibration of both vanilla and exotic options under both diffusion and pure jump processes with and without stochastic volatility. We train our neural network models under different number of layers, neurons per layer, and various different activation functions in order to find which combinations work better empirically. For training, we consider various different loss functions and optimization routines. We demonstrate that deep neural networks exponentially expedite option pricing compared to commonly used option pricing methods which consequently make calibration and parameter estimation super fast.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)