Summary

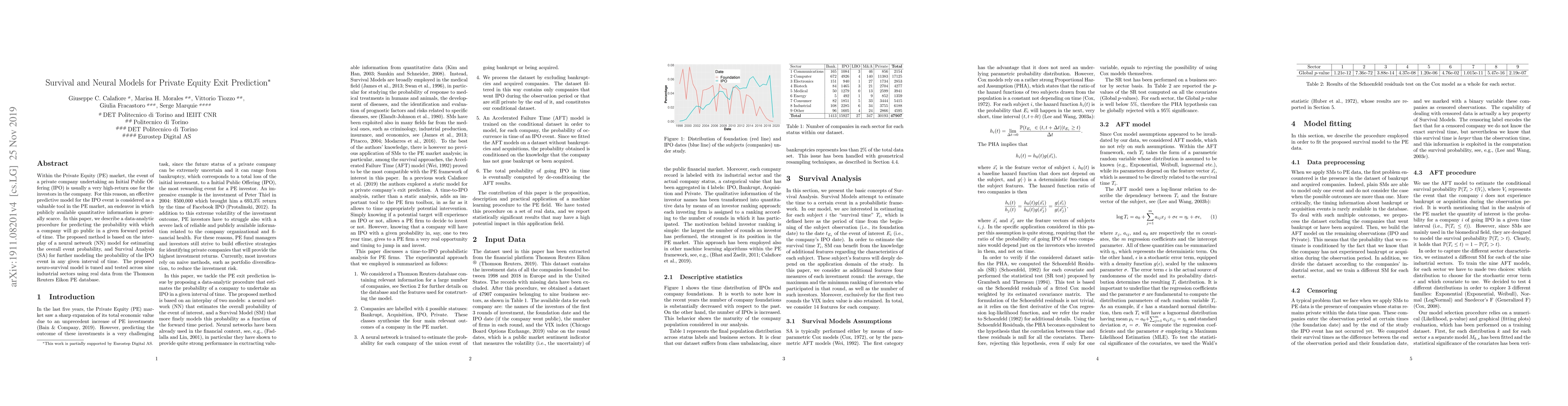

Within the Private Equity (PE) market, the event of a private company undertaking an Initial Public Offering (IPO) is usually a very high-return one for the investors in the company. For this reason, an effective predictive model for the IPO event is considered as a valuable tool in the PE market, an endeavor in which publicly available quantitative information is generally scarce. In this paper, we describe a data-analytic procedure for predicting the probability with which a company will go public in a given forward period of time. The proposed method is based on the interplay of a neural network (NN) model for estimating the overall event probability, and Survival Analysis (SA) for further modeling the probability of the IPO event in any given interval of time. The proposed neuro-survival model is tuned and tested across nine industrial sectors using real data from the Thomson Reuters Eikon PE database.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEarly-Exit Neural Networks with Nested Prediction Sets

Stephan Mandt, Dan Zhang, Eric Nalisnick et al.

CRISP-NAM: Competing Risks Interpretable Survival Prediction with Neural Additive Models

Dhanesh Ramachandram

Heart Failure Care and Outcomes After Private Equity Acquisition of U.S. Hospitals.

Liu, Michael, Wadhera, Rishi K, Johnson, Daniel Y et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)